Post-Election Rally Boosts Market, But Volatility Fears Remain

4 MIN READ

Team BitDelta Pro • 18 Nov 2024

The stock market cooled off this past week after its strong post-election performance. The major indices all ended lower – the S&P 500 fell 2.30%, the Dow Jones dropped 1.39%, and the tech benchmark Nasdaq Composite, declined the most at 3.49%. Despite this recent dip, the S&P 500 is still having an impressive year, up more than 26% since January and holding onto a 1.5% gain since the election.

Seasonal Strength in S&P 500

The overall outlook for the S&P 500 index remains positive. Fundamentally, the latest inflation report from October came in as expected, indicating a continued downward trend in inflation. However, some areas are still seeing more persistent price pressure, particularly in housing costs, rent, and car insurance. Despite this, market sentiment suggests inflation will gradually approach the Federal Reserve’s goal of 2%, with the potential to settle between 2-3% in the longer run.

The market has entered a seasonally strong period, with November and December historically delivering positive stock performance, particularly in presidential election years. This year’s post-election rally has already significantly boosted the market performance. While continued momentum is possible, supported by corporate earnings growth, persistent policy uncertainty is expected to weigh on markets. The overall bull market appears healthy, but expect some bumpy rides along the way.

Technical Analysis

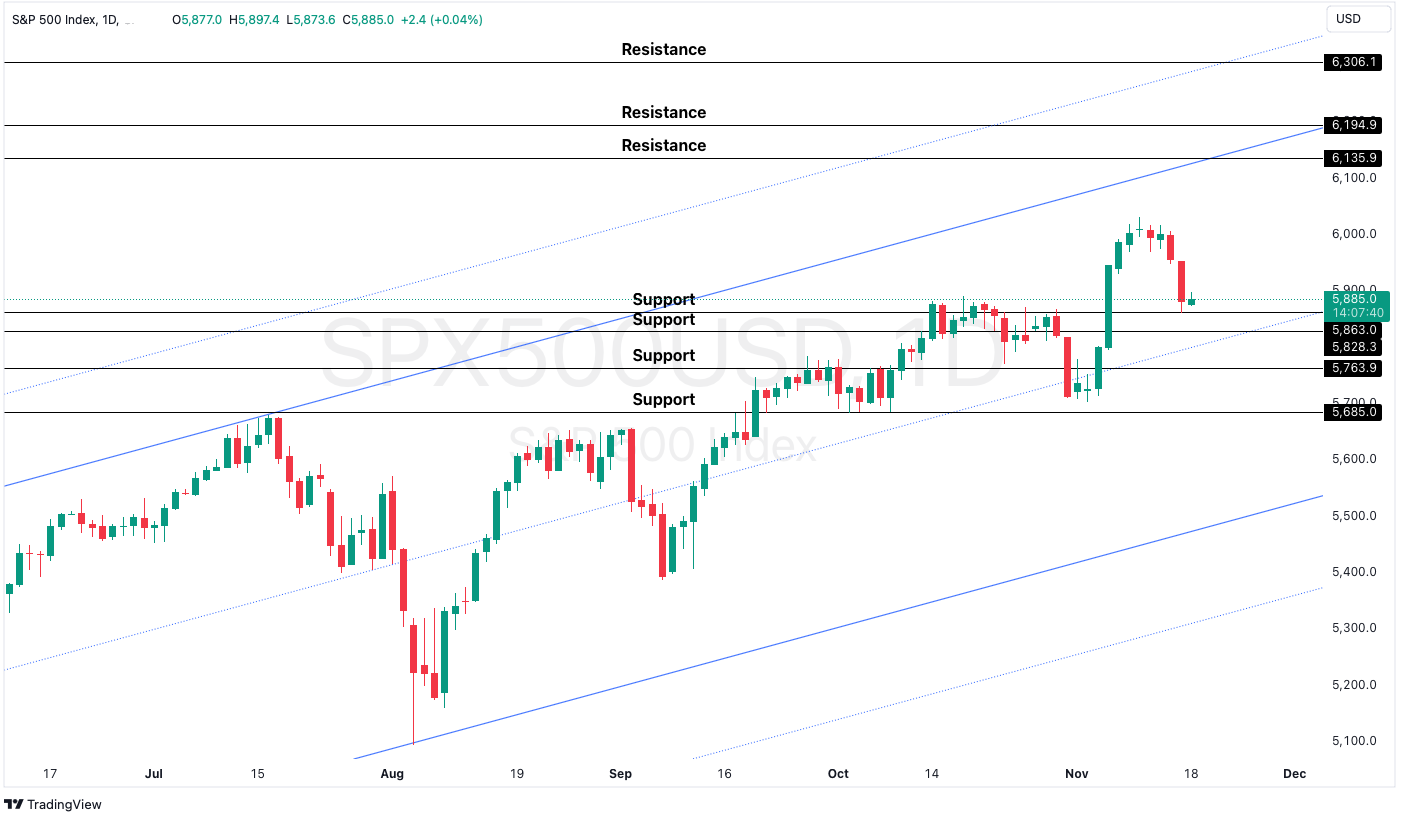

Image Source: TradingView

The S&P 500 remains in a strong uptrend, with the current pullback viewed as a consolidation before the next leg higher. Should today’s closing price maintain above the support level at $5,863, the index could target the next resistance at $6,135.90. A failure to hold this support would suggest a potential move towards the next lower support level. Overall, market sentiment remains bullish, suggesting that accumulating near-support levels offers a more favorable position for future buying opportunities.

DISCLAIMER

This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta Pro does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in traditional securities (such as forex currency pairs, stocks, bonds, and commodities) carries inherent risks, including potential loss of principal. Users are encouraged to carefully evaluate their financial objectives, conduct their own research, and seek independent financial advice before making any trading decisions. BitDelta Pro is not liable for any losses or damages resulting from actions taken in response to this communication.

Register an Account

Start your trading journey and explore limitless trading opportunities

Sign up today and gain access to global markets!

Register Now

;?>)