Gold experienced some selling pressure during the Asian session on Thursday but remained within the $2,635-$2,657 range it has held over the past week.

Geopolitical Tensions Counter Decreasing Demand

The decline was driven by expectations that the Federal Reserve would be cautious about cutting interest rates, supported by hawkish comments from several officials, including Jerome Powell. As a result, US Treasury bond yields rebounded slightly from their lowest levels in over a month, diminishing the appeal of non-yielding assets like gold.

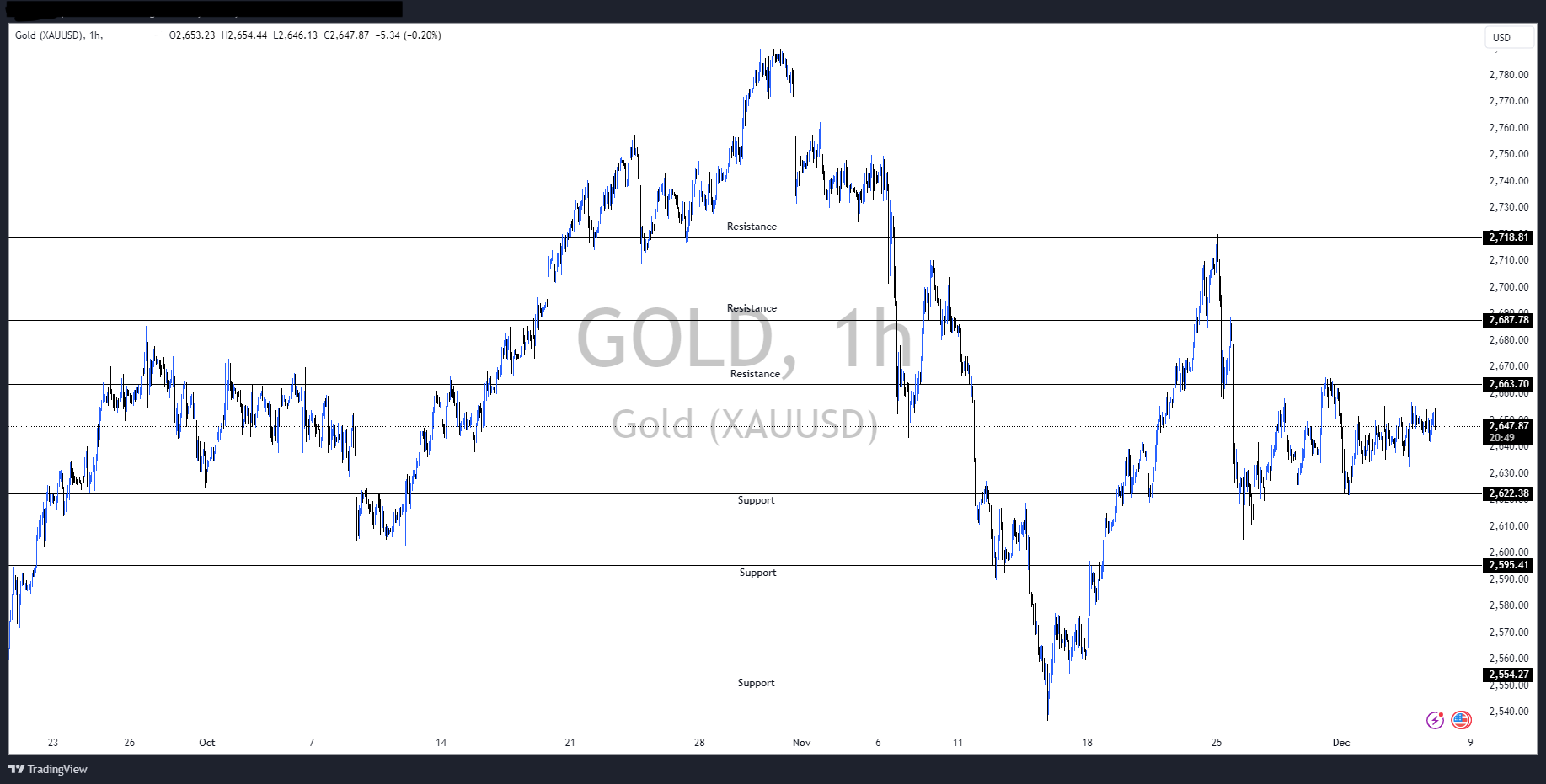

Image Source: TradingView

Additionally, the positive market sentiment, or “risk-on” environment, further reduced demand for safe-haven gold. However, geopolitical tensions, particularly the ongoing Russia-Ukraine conflict and concerns about US President-elect Trump’s trade policies, provided some support for gold.

Potential Downside Risks for Gold Prices

Gold is currently moving sideways ahead of the upcoming Initial Jobless Claims and Nonfarm Payrolls data. If it fails to break through the $2,663 resistance level, or if the geopolitical environment remains calm, the price of gold might fall towards the key support area of around $2,622. This could lead to increased selling pressure, potentially pushing the price below the psychological level of $2,600.