The British Pound GBP is in a tricky spot as investors and analysts debate whether the Bank of England (BoE) will begin cutting rates soon or keep them high for longer. With inflation still a concern and economic uncertainty lingering, markets are trying to predict the central bank’s next move.

Mixed Signals from the Bank of England

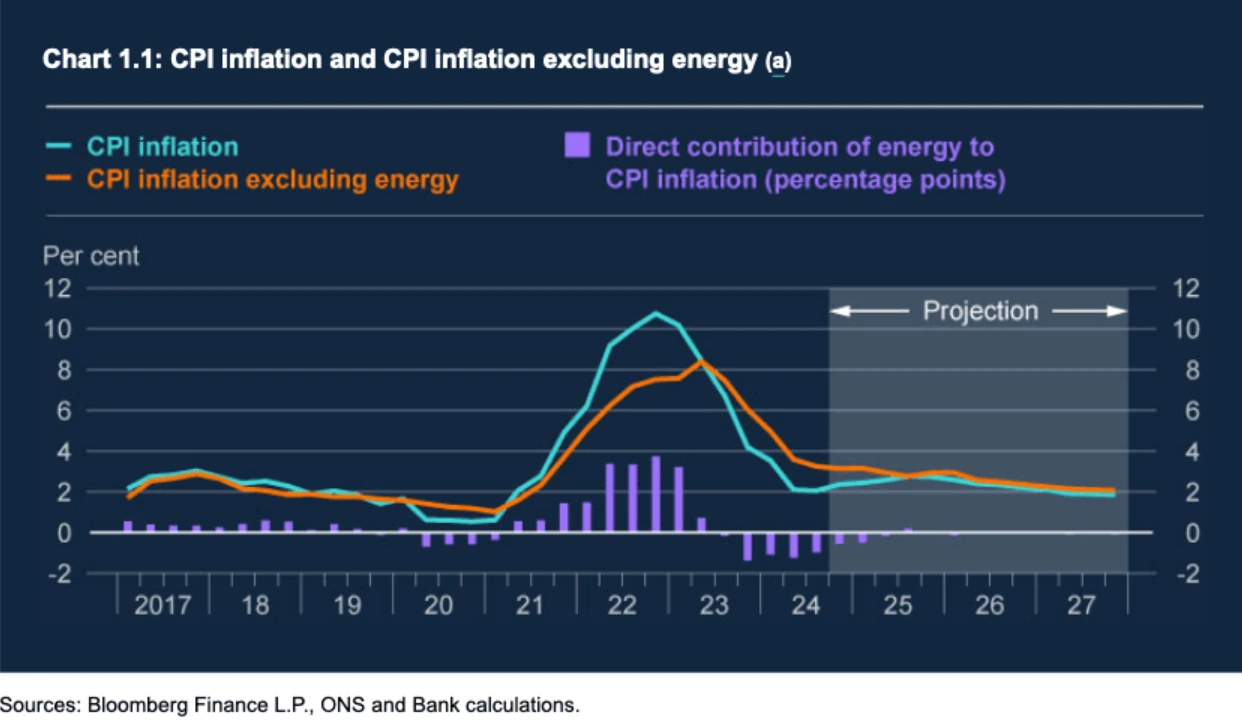

The BoE has been cautious about cutting interest rates, even as inflation has come down from its highs. The market is pricing in a 25-bps rate cut this Thursday, despite the central bank’s concern as this could make life more expensive for businesses and consumers. The inflation in the UK remains relatively high compared to other countries, and the labour market is still strong. If wage growth continues to push prices higher, the BoE may feel pressured to keep rates higher for longer to prevent another inflation spike.

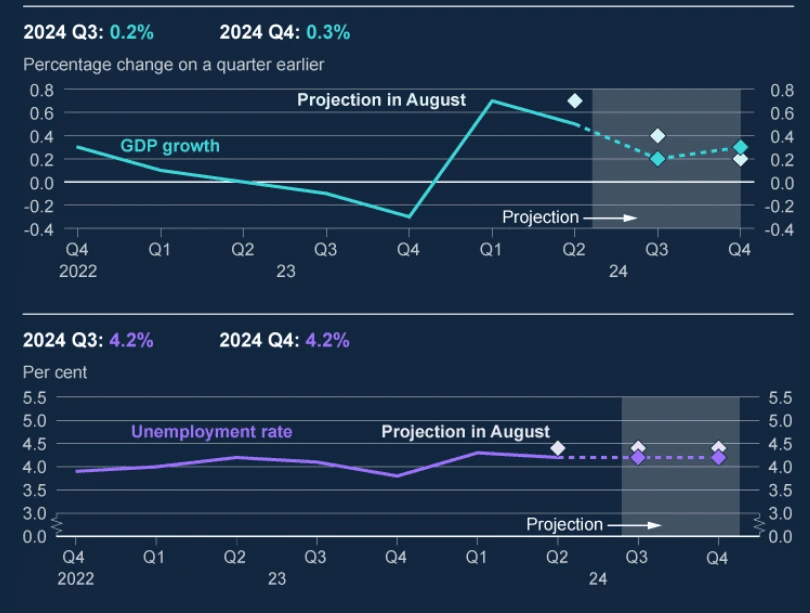

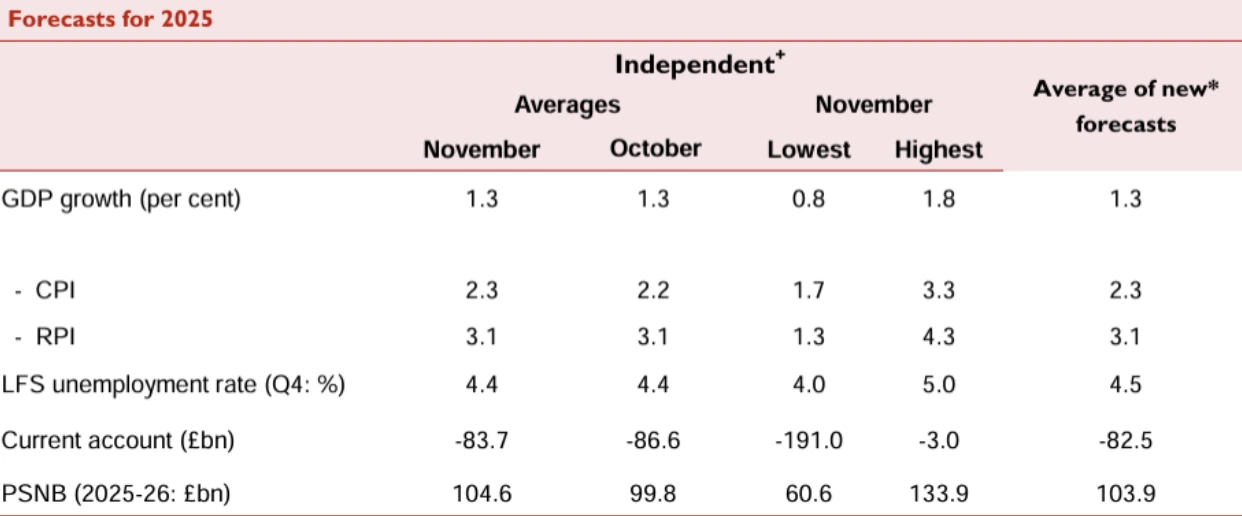

The bank’s latest economic projections predict slower growth and lower inflation in the coming years. GDP growth, which was previously expected to be 1.5% in 2025, is now likely to be revised to 1.0%, following zero growth in the third and fourth quarters of 2024. Inflation is expected to decrease over time, with the inflation rate projected to reach 1.7% by Q1 2027.

Growth and Unemployment Last Forecasts

Market Expectations from Thursday’s BoE Meeting

There are layers of uncertainty around the GBP/USD exchange rate, as the pair has recovered slightly with a weaker dollar, but it remains unstable. A Dovish policy from BoE—before the US Federal Reserve—could push the GBP down again.

If the Bank of England cuts rates on February 6 and marks a shift towards more aggressive easing to counteract the stagnating UK economy, it could be forced into abandoning the interest rate-cutting cycle as soon as the second half of 2025 as inflation risks grow.

UK CPI Forecasts for 2025

The more dovish the outcome, the more the GBP could fall. A rate cut would make borrowing cheaper but could weaken the pound. The opposite scenario is also valid. If the BoE holds rates steady or signals a slower pace of cuts, the GBP might gain strength.

Technical Analysis

From a technical outlook, the GBP/USD is struggling to break above the key resistance near $1.2600. If the BoE cuts rates as expected, we could see the pair resuming a bearish trend towards the $1.2280 level.

Image Source: TradingView | For Illustrative Purposes Only

Overall, the outlook remains uncertain. For now, the market should look for the BoE’s next move today, and much will depend on inflation data, wage growth, and global market trends later this year.