Gold Prices Unsteady as Feds Signal Less Dovish Outlook

2 MINS READ

Team BitDelta Pro • 05 Dec 2024

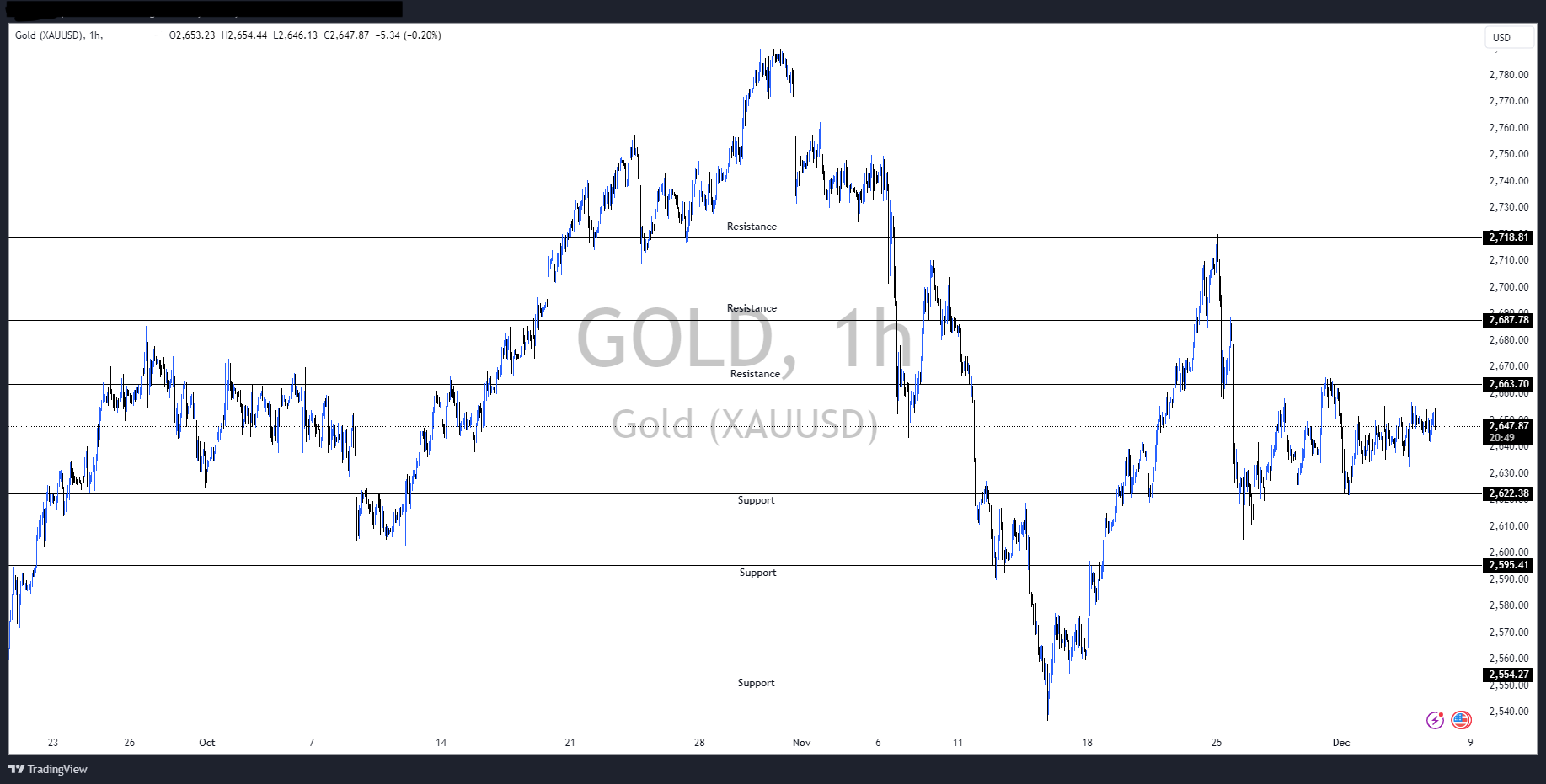

Gold experienced some selling pressure during the Asian session on Thursday but remained within the $2,635-$2,657 range it has held over the past week.

Geopolitical Tensions Counter Decreasing Demand

The decline was driven by expectations that the Federal Reserve would be cautious about cutting interest rates, supported by hawkish comments from several officials, including Jerome Powell. As a result, US Treasury bond yields rebounded slightly from their lowest levels in over a month, diminishing the appeal of non-yielding assets like gold.

Image Source: TradingView

Additionally, the positive market sentiment, or “risk-on” environment, further reduced demand for safe-haven gold. However, geopolitical tensions, particularly the ongoing Russia-Ukraine conflict and concerns about US President-elect Trump’s trade policies, provided some support for gold.

Potential Downside Risks for Gold Prices

Gold is currently moving sideways ahead of the upcoming Initial Jobless Claims and Nonfarm Payrolls data. If it fails to break through the $2,663 resistance level, or if the geopolitical environment remains calm, the price of gold might fall towards the key support area of around $2,622. This could lead to increased selling pressure, potentially pushing the price below the psychological level of $2,600.

DISCLAIMER

This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta Pro does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in traditional securities (such as forex currency pairs, stocks, bonds, and commodities) carries inherent risks, including potential loss of principal. Users are encouraged to carefully evaluate their financial objectives, conduct their own research, and seek independent financial advice before making any trading decisions. BitDelta Pro is not liable for any losses or damages resulting from actions taken in response to this communication.

Register an Account

Start your trading journey and explore limitless trading opportunities

Sign up today and gain access to global markets!

Register Now

;?>)