The US Federal Reserve (Fed) announced on March 19 that it will keep interest rates steady at 4.50% (within a 4.25%-4.50% range). While this decision was expected, its implications for investors, traders, and the economy are significant.

Here’s a breakdown of what this means and how markets may react.

Key Takeaways

- Interest rates remain unchanged at 4.50%, with two expected cuts later this year.

- Inflation remains a concern, especially with new tariff policies potentially driving prices up.

- The labour market appears stable, though some indicators suggest uncertainty.

- The Fed is easing its Quantitative Tightening (QT) by reducing monthly US Treasury redemptions from $25 billion to $5 billion. This increases liquidity in financial markets.

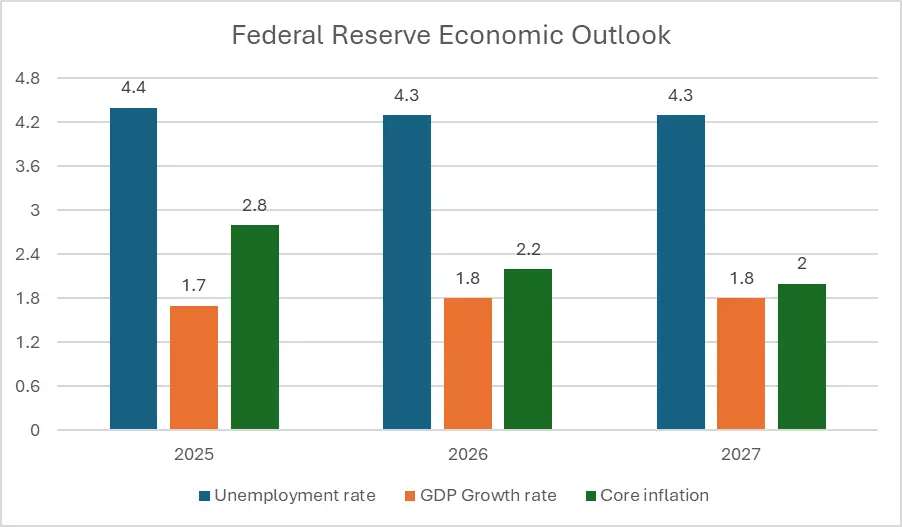

- The Fed has cut the forecasted growth rate from 2.1% to 1.7% for 2025.

Fed Economic Outlook – A Summary

Why Did the Fed Keep Rates Steady?

The Federal Open Market Committee (FOMC) is taking a cautious approach. While the economy grows, inflationary pressures and global uncertainties remain key concerns. The Fed aims to balance economic growth and inflation control by maintaining current interest rates.

However, inflation may rise due to tariff policies introduced by the US government. This means the Fed will likely monitor economic data closely before making further decisions.

How Does This Affect Markets?

Public Equities

More liquidity from reduced QT measures is bullish for stocks. Increased capital in the financial system can lead to:

- Higher corporate earnings

- Stronger investor sentiment

- More demand for equities

However, market volatility remains a risk, especially with potential policy changes and global economic shifts.

Bond Market & Interest Rates

With the Fed’s decision to reduce the treasury redemption cap, treasury yields are expected to decline. This will also benefit corporate bonds, as lower yields reduce spreads and increase bond valuations. This is particularly true for investment-grade bonds.

What Should Investors Do Now?

- Monitor inflation data: The Fed’s stance may shift based on upcoming economic reports.

- Stay updated on Fed policy: Any unexpected shifts can impact markets significantly.

- Monitor economic data: The unwinding of QT measures indicates a shift towards a looser monetary policy, as the Fed expects a weaker economy.

For deeper insights and market updates, visit our blog, where you will get expert analysis on the latest trends in global markets. Our experts break down the market into simple digestible bits so that you can trade like a pro.