Labour Market Insights: Trends and Sectors Poised for Record Highs

4 MINS READ

Team BitDelta Pro • 09 Dec 2024

Nonfarm Payroll Higher Than Expected, Unemployment Rate as Predicted, Wages Surge, But Labour Force Participation Drops.

Key Takeaways

- Job Growth: Nonfarm payrolls added 227,000 jobs, slightly beating expectations and with upward revisions to previous months.

- Unemployment rate ticked up to 4.2%, showing subtle market cooling.

- Wages: Hourly earnings grew 0.4%, outpacing predictions.

- Labour participation dropped to 62.5%, indicating potential workforce disengagement.

The latest labour market report delivered mixed signals. The US economy added 227,000 jobs in the most recent reporting period, surpassing expectations, with upward revisions to previous months indicating sustained job growth. However, the unemployment rate slightly rose to 4.2%, suggesting that while the labour market remains strong, there may be some signs of softening.

Despite these fluctuations, the economic outlook remains cautiously optimistic. Steady hiring continues to provide some protection against recession concerns, while a gradual easing in market pressures sets the stage for potential monetary policy actions.

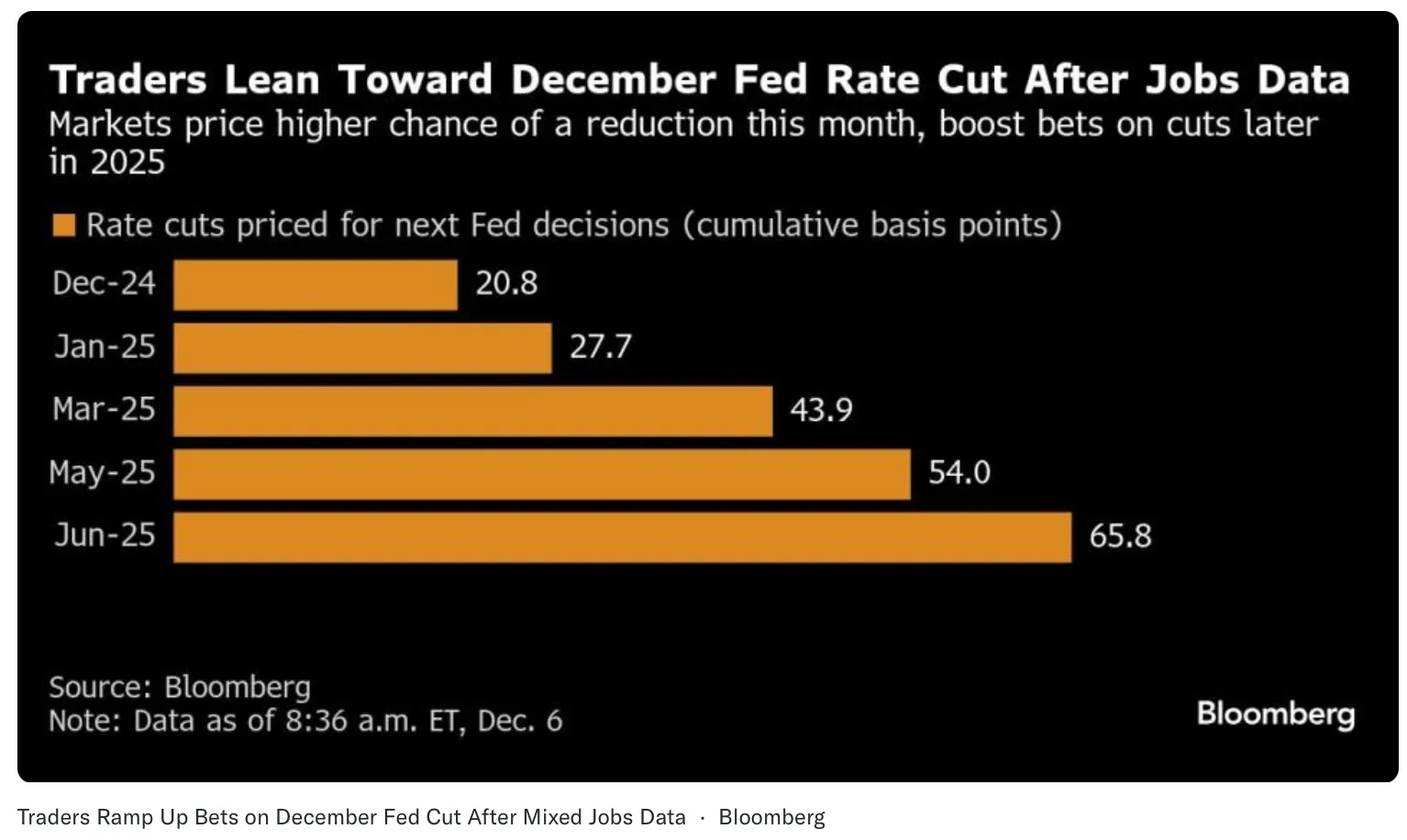

The Federal Reserve seems ready to take a strategic approach, with markets expecting a likely rate cut in December. This move signals a shift from the usual reactive measures seen in past economic cycles. Instead of cutting rates in response to a crisis, the Fed appears to be acting proactively to guide the economy towards a “soft landing”.

If the Fed manages rate cuts effectively, and they coincide with expected growth in earnings per share (EPS) for major companies, this could create a supportive environment for financial markets. EPS growth suggests that corporate profitability is on the rise, which could encourage more investments and drive stock prices higher. The potential for a “soft landing”, combined with positive earnings reports and strategic monetary policy, could push the US stock market to new record highs.

Technical Analysis

S&P 500

In the weekly timeframe, the S&P 500 has shown a clear uptrend since late 2023. This trend is marked by the formation of consistent higher highs and higher lows, reinforcing the bullish sentiment in the market.

Accumulation buying can be considered at the support level. However, caution is advised at resistance levels, as pullbacks may occur. These pullbacks are likely to be temporary and part of the continuation of the upward trend.

| S1: $6,085.00 | R1: $6,094.20 |

| S2: $6,074.70 | R2: $6,119.70 |

NASDAQ

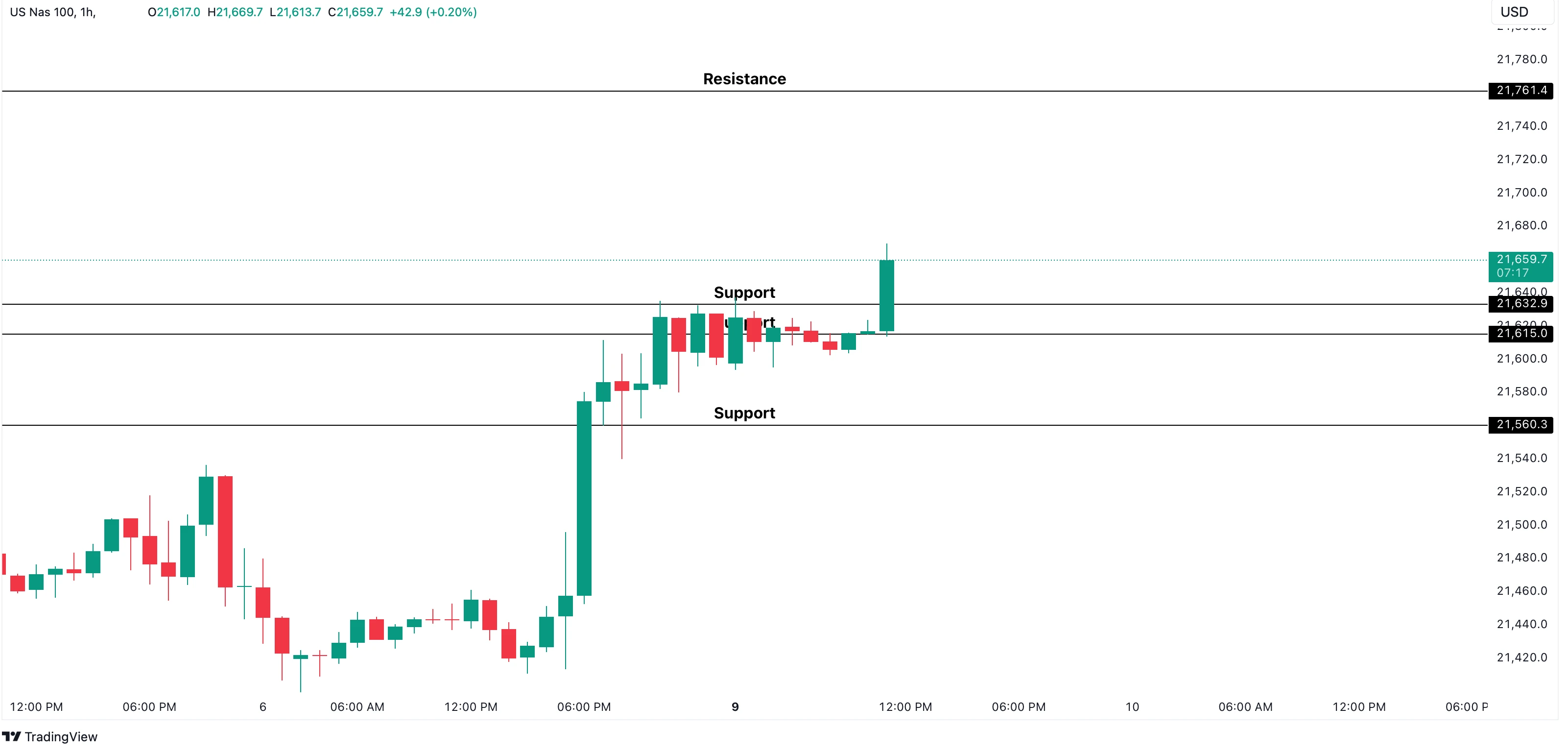

The Nasdaq, like the S&P 500, has demonstrated a well-defined uptrend, driven by strong performance in the technology sector. The tech-heavy index often follows trends that are more pronounced than those of broader indices due to the higher growth potential of technology stocks. Historically, US equities, including the Nasdaq, tend to close Q4 on a strong note, which could support further gains.

Additionally, as companies in the tech sector continue to innovate and adapt to changing market dynamics, they could see sustained growth in earnings. This, combined with supportive monetary policy and strong investor confidence, could drive the Nasdaq to keep reaching new all-time highs. However, with Trump returning to office, potential changes in tax policies could come into play and exert pressure on the stock market. At that point, market participants would need to reassess and navigate the potential impact of such policies.

Strategic buying opportunities can be found during pullbacks near key support levels.

| S1: $21,632.90 | R1: $21,761.00 |

| S2: $21,615.00 |

DISCLAIMER

This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta Pro does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in traditional securities (such as forex currency pairs, stocks, bonds, and commodities) carries inherent risks, including potential loss of principal. Users are encouraged to carefully evaluate their financial objectives, conduct their own research, and seek independent financial advice before making any trading decisions. BitDelta Pro is not liable for any losses or damages resulting from actions taken in response to this communication.

Register an Account

Start your trading journey and explore limitless trading opportunities

Sign up today and gain access to global markets!

Register Now

;?>)