The year 2025 stands on the horizon as a pivotal moment, shaped by Donald J. Trump’s return to the White House on Monday, January 20, 2025. His influence, both actual and expected, has a major impact on the global economy and politics. The prospect of a second Trump presidency brings a mix of optimism for domestic growth and apprehension about global instability, creating a complex set of opportunities and risks.

A Trump presidency in 2025 is expected to reignite the pro-business policies that defined his first term. Tax cuts, deregulation, and a focus on domestic manufacturing could significantly boost the US economy. Sectors like technology, energy, and infrastructure are likely to thrive. This optimism is rooted in the belief that Trump’s policies will create a favourable environment for corporate profitability and economic expansion.

Lessons from the 2017 Tax Cuts

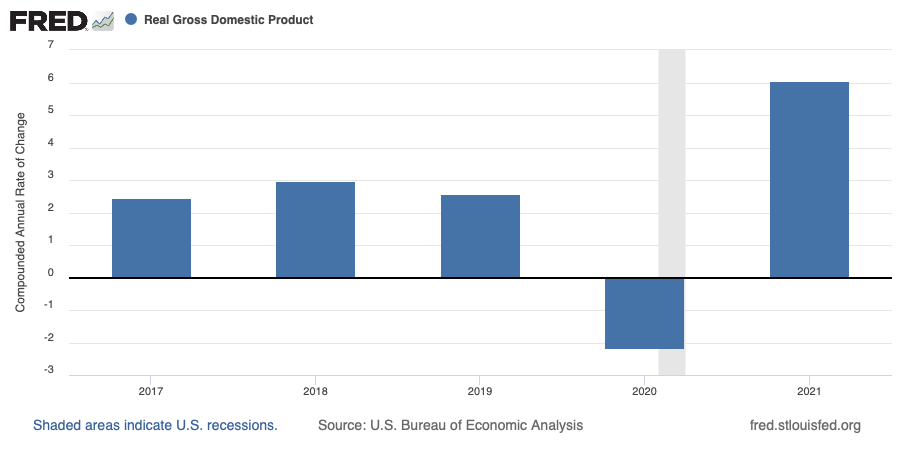

The 2017 Tax Cuts and Jobs Act (TCJA) offers a glimpse into what 2025 might hold. The tax cuts initially boosted GDP growth to 2.9% in 2018 and propelled corporate profits, with S&P 500 earnings surging by 20% that year. However, the long-term economic impact was limited, as growth slowed to 2.3% by 2019, and much of the tax savings were funnelled into stock buybacks rather than productive investments. As Trump returns to office in 2025, similar policies could provide a short-term economic boost but may struggle to deliver sustained growth without addressing underlying structural challenges.

Stock Market Forecast for 2025

Image Source: Investing.com

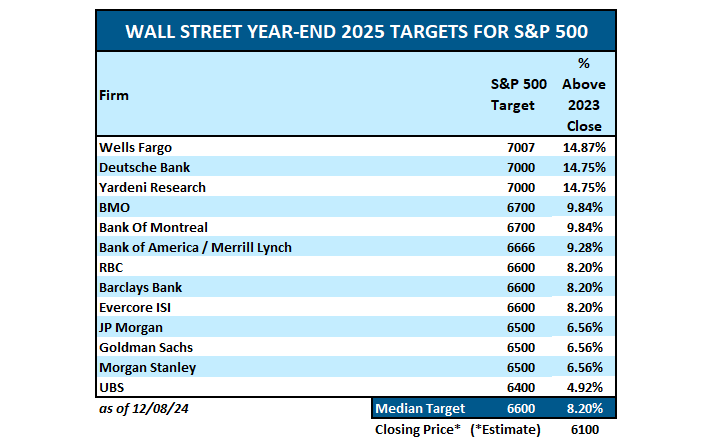

Market forecasters are optimistic about a broad-based rally in 2025, driven by Trump’s pro-business agenda. Following his re-election in November 2024, the Dow Jones Industrial Average, S&P 500, and Nasdaq surged, reflecting investor enthusiasm. The S&P 500 is predicted to reach 7,000 points, while the Dow Jones is expected to follow a similar trajectory, with potential gains of 8-12%, driven by strong performance in industrials, energy, and financial sectors.

The Nasdaq, which rose nearly 29% in 2024, is expected to remain a strong performer, particularly in technology and AI-driven sectors. Forecasts suggest the Nasdaq could climb by 10-15%, fuelled by continued innovation in artificial intelligence, semiconductor technology, and biotech. However, some caution remains, as Trump’s proposed tariffs and immigration policies could introduce volatility, particularly for tech companies reliant on global supply chains.

Inflation and Monetary Policy

Inflation remains a critical concern as the year progresses. Trump’s focus on tariffs and immigration restrictions will likely exert upward pressure on prices, complicating the Federal Reserve’s efforts to maintain stability. Core inflation in the US could hover around 2.5%, above the Fed’s target, potentially limiting the central bank’s ability to cut interest rates as aggressively as markets hope. This delicate balancing act between growth and inflation will the year’s defining feature.

Globally, central banks face similar challenges. The ECB and the BoE are expected to cut rates more aggressively than the Fed, which could lead to a stronger US dollar. While a strong dollar benefits American consumers, it could weigh heavily on emerging markets, exacerbating global trade imbalances and financial instability. The interplay between Trump’s policies and central bank actions will be a key theme, with any missteps likely to trigger market turbulence.

Geopolitical Risks

Beyond economics, the geopolitical implications of a Trump presidency are profound. His “America First” stance could lead to a more isolationist US foreign policy, potentially weakening alliances and creating power vacuums in regions like Europe and Asia. The ongoing tensions between the US and China could escalate, particularly if Trump follows through on his campaign promises to impose up to 60% tariffs on Chinese imports and 10-20% on goods from other countries. Such measures could trigger retaliatory actions, leading to a global trade war and disrupting supply chains worldwide.

Trump’s unpredictable style adds another layer of complexity. His willingness to challenge international norms and institutions could create a more fragmented and volatile global order. This unpredictability makes it difficult for investors and policymakers to predict the future, increasing the importance of resilience and adaptability in navigating the year ahead.

High Stakes & Strategic Navigation

2025 promises to be a year of high stakes, with Trump’s potential return serving as the central narrative. While his policies could drive economic growth and market optimism in the US, the risks of trade wars, inflation, and geopolitical instability loom large. The global economy will need to navigate this uncertainty with care, focusing on resilient sectors and diversified strategies to mitigate risks. As the world prepares for a potential Trumpian resurgence, the only certainty is that 2025 will be a year of profound transformation, demanding both caution and strategic creativity to navigate effectively.