Tomorrow’s rate hike by the BOJ could solidify its shift towards monetary policy normalisation. Japan’s near-zero interest rates have shaped global financial strategies for decades. However, rising inflation and changing economic conditions are driving the need for a new approach.

Fundamental Outlook

The Bank of Japan (BOJ) has again captured market attention as it gears up for its first interest-rate decision of 2025. Following a surprising rate hike in 2024—for the first time in years—the BOJ is widely expected to raise rates again by 25 bps on Friday, January 24, potentially signalling a major shift in Japan’s economic and monetary strategy.

The BOJ’s anticipated move will most likely raise Japan’s interest rates to their highest level in 17 years, breaking away from the ultra-loose monetary policy that has defined the central bank’s approach for decades. Here’s an overview of the decision and its potential market impact.

Japan has long stood out among major economies for its near-zero interest rates, a strategy aimed at combating deflation and spurring economic growth. However, inflation has consistently exceeded the BOJ’s 2% target since 2022, gradually prompting the central bank to unwind its accommodative stance. The 2024 rate hike marked a significant milestone, and markets are pricing in a 92% probability of another increase in 2025.

This decision is closely watched because it offers insight into how Japan plans to tackle inflation without hurting its economic recovery. Policymakers face a tough challenge: raising rates enough to manage inflation while avoiding harm to Japan’s fragile recovery.

What to Watch for in the Decision

The central bank may take a cautious approach to avoid rattling markets. Key implications of a potential rate hike include:

- Strengthening the Yen: Higher interest rates typically attract foreign investors seeking better returns, which could bolster the yen. However, Rabobank analysts caution that the yen’s gains might remain limited unless the BOJ signals a more aggressive stance on future rate increases.

- Pressure on Exporters: A stronger yen makes Japanese goods more expensive in international markets, potentially hurting the country’s export-driven economy. Additionally, Donald Trump’s presidential tariffs could significantly impact Japanese exports, and sectors like automotive and electronics could face challenges.

- Impact on Bonds and Investments: Japan’s prolonged low-rate environment has been a cornerstone of global investment strategies. A shift to higher rates could disrupt these dynamics, possibly tightening global liquidity.

Long-Term Market Implications

While some argue that the BOJ’s decision is already priced into markets, the broader implications could reshape investor strategies for years. OCBC analysts suggest that the impact on USD/JPY exchange rates may already be reflected in current valuations. However, the BOJ’s forward guidance will be key to determining how markets react. If the central bank signals a series of rate hikes for 2025, it could lead to:

- Further Yen Strength: A more hawkish tone from the BOJ could make the yen more appealing, potentially reversing its recent underperformance.

- Global Investment Adjustments: Investors accustomed to Japan’s cheap funding environment may need to rethink their strategies, with ripple effects across global equity and bond markets.

A New Era for Japan’s Monetary Policy

The future trajectory of Japan’s economy and its influence on global markets relies on the BOJ’s ability to balance higher rates with the risk of slowing growth. Investors should brace for potential market turbulence, as this decision could start a new chapter in Japan’s economic strategy.

Technical Outlook

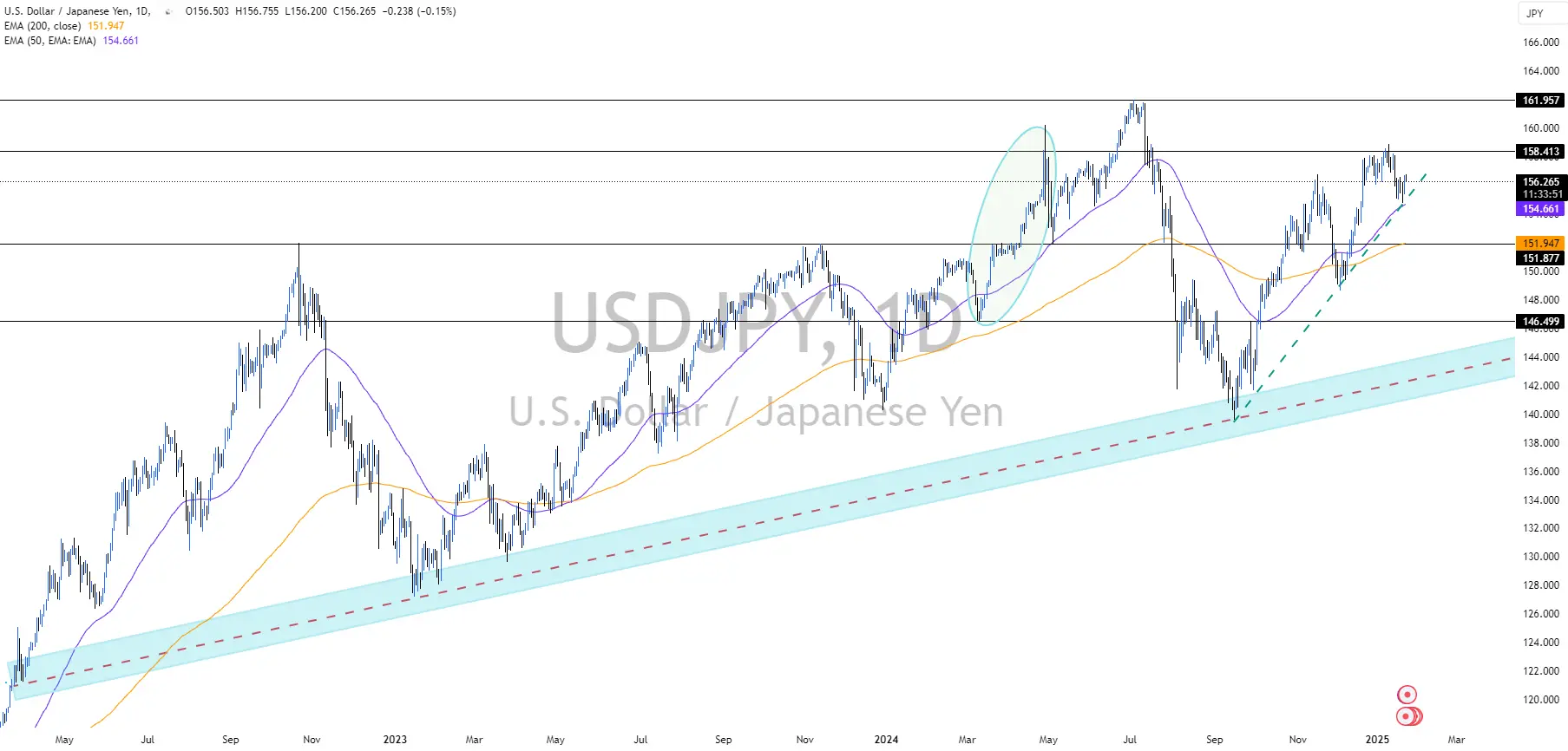

From a technical standpoint, USD/JPY holds well above EMA-50 and EMA-200. It has seen bullish momentum recently, driven by the Fed’s neutral stance on interest rates (4.25%-4.5%) and uncertainty under the Trump administration, fuelling demand for the US dollar. However, the BOJ’s expected rate hike from 0.25% to 0.5% leads to a short-term bearish correction.

Image Source: TradingView | For Illustrative Purposes Only

Key levels to watch are $151.88 and $146.5 for support. A more hawkish BOJ stance could drive further yen strength, while dovish signals would likely push the price to resume its bullish trend.