If you’re following the ups and downs of the Euro and US Dollar, lots is happening that could impact exchange rates. Let’s break it down in simple terms.

Europe’s Economy: A Mixed Bag

The Eurozone recently reported a trade surplus of €15.5 billion, lower than last year’s numbers. Inflation is slowly cooling down, dropping from 2.5% in January to 2.4% in February, but energy prices remain high. Meanwhile, Germany—the Eurozone’s economic powerhouse—is ramping up spending on defence and infrastructure, which could push its debt-to-GDP ratio to 100% by 2034. Since Germany is borrowing more money, this can influence the entire Eurozone’s financial health.

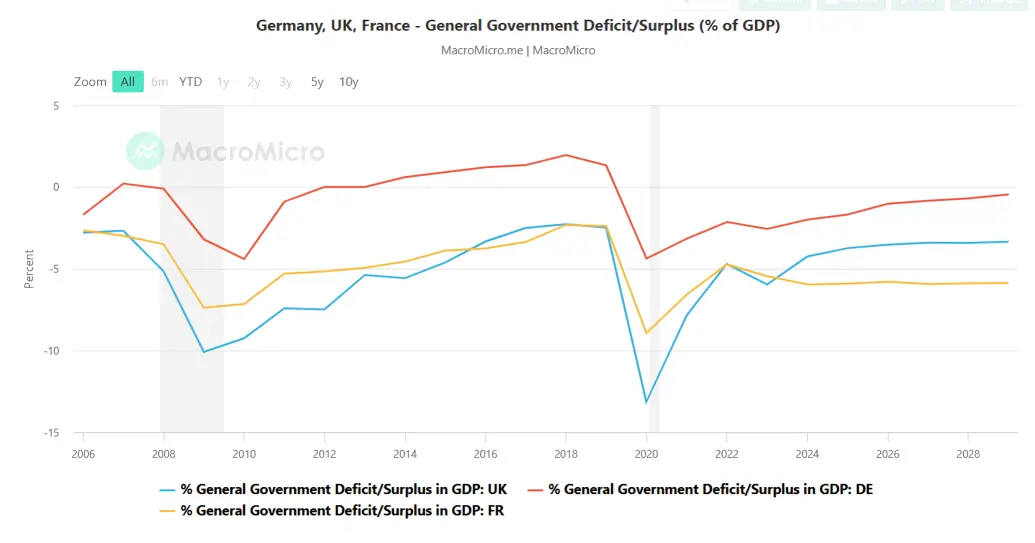

How Germany’s Fiscal Health Compares to Others in Europe

Germany clearly has the room to spend money compared to its peers.

How Interest Rates Affect the Euro

The European Central Bank (ECB) is trying to boost the economy by cutting interest rates. They have reduced:

- Deposit rate to 2.50%

- Main refinancing rate to 2.65%

- Marginal lending rate to 2.90%

Lower interest rates can make borrowing cheaper, encouraging spending and investment, which could boost the Euro in the medium term.

Why the Euro Could Strengthen

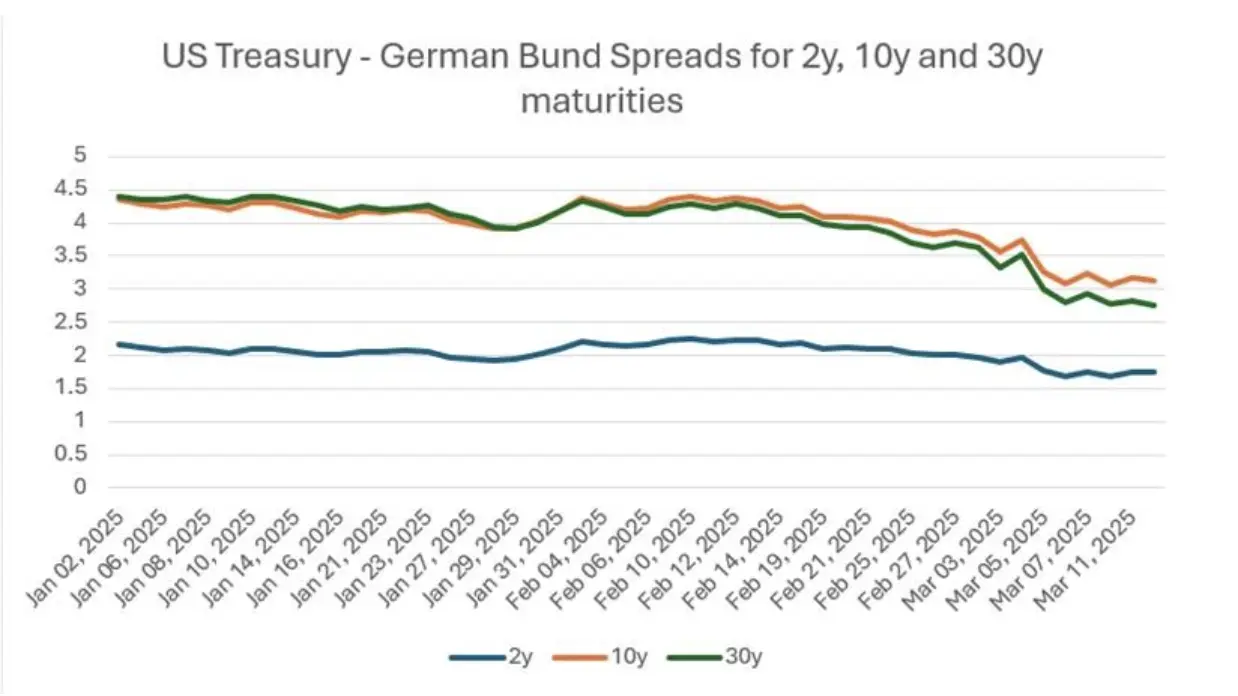

- Bond Markets are Shifting: The gap between US Treasury and German Bund yields is narrowing. In simple terms, investors may start favouring the Euro over the Dollar when European yields go up.

- Government Spending: With Germany increasing its spending, other European countries might follow suit. This could stimulate the economy and push the Euro higher.

- Rate Cuts Could Help: Lower interest rates generally support economic growth, strengthening the Euro over time despite short-term outflows.

What Could Hold the Euro Back?

- Tariff Wars: Trade tensions between the US and EU could hurt exports, making it harder for the Euro to gain momentum.

- Debt Concerns: Many Eurozone countries are already deep in debt. Without Germany’s help, they might struggle to keep up.

- US Interest Rates: The US Federal Reserve (led by Jerome Powell) isn’t backing down on fighting inflation. If they keep interest rates high, the US Dollar could remain strong.

Bottom Line

The Euro is at an interesting crossroads. While economic stimulus and government spending could help it gain ground, uncertainty around trade, debt, and US interest rates could limit its rise. If you’re monitoring exchange rates, pay close attention to how Germany’s spending plans unfold and how the US responds to inflation in the coming weeks.

Stay tuned for more updates as we track these market trends!