Fed Signals Slower Rate Cut Path Despite Third Consecutive Reduction

4 MINS READ

Team BitDelta Pro • 19 Dec 2024

The Federal Reserve delivered its third consecutive rate cut yesterday, bringing the federal funds rate to 4.25%-4.50% while signalling a more cautious approach to future easing. In their latest quarterly projections (Dot Plot), Fed officials significantly scaled back their rate cut expectations for 2025. The median forecast shows only two 25-basis-point reductions next year, down from previous estimates, bringing rates to 3.75%-4% by year-end. This contrasts with most economists surveyed by Bloomberg, who anticipate three cuts in 2025.

Fed Chair Jerome Powell emphasised that with cumulative cuts now totalling 100 basis points from the peak, the stance of monetary policy has meaningfully eased. “We can therefore proceed carefully as we consider further adjustments to our policy rate,” Powell stated during the post-meeting press conference. He maintained that while the policy remains restrictive, the Fed is “still on a path to cut rates”.

Revised Economic Projections Highlight Inflation Concerns

The updated economic projections revealed heightened concerns, with officials raising their end-2025 inflation forecast to 2.5% from 2.1% in September. The unemployment rate is expected to settle at 4.3% next year, while GDP growth forecasts were slightly upgraded to 2.1%.

Looking ahead, Powell addressed questions about potential Trump administration trade policies, noting that while some policymakers have begun incorporating possible effects of higher tariffs into their forecasts, the impact remains highly uncertain. “We don’t know much about the actual policies,” Powell marked, suggesting it was premature to conclude.

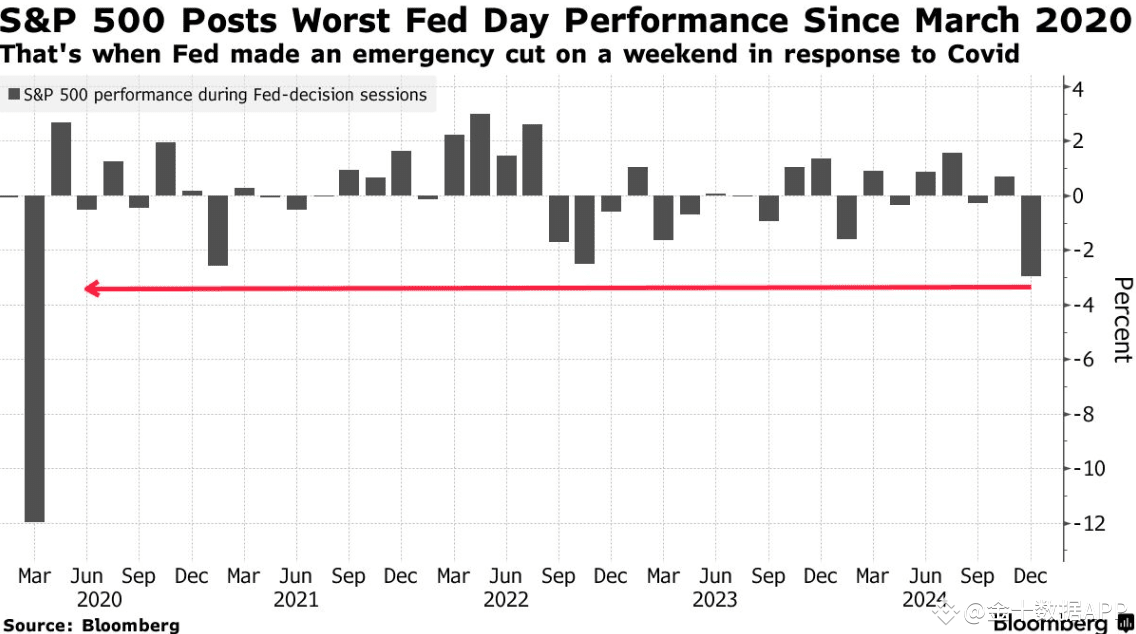

Market Reaction: S&P 500 Drops Amid Hawkish Fed Signals

Markets responded negatively to the Fed’s more hawkish tone, with the S&P 500 experiencing its worst decline since January, dropping 2%. Treasury yields reflected the shift in rate expectations, with the 2-year yield jumping 11 basis points to 4.35%, while the dollar strengthened against major currencies. While the market initially reacted negatively to the Fed’s hawkish tone, a closer look suggests this reaction may have been exaggerated.

Powell’s commentary revealed a shift in the Fed’s risk assessment. This shift showcases increased concern about inflation persistence while expressing less worry about labour market conditions. This perspective reflects the underlying strength of the US economy, which gives the Fed more room for careful policy adjustment.

Economic Projections Show Strength Amid Inflation Concerns

A careful examination of the Fed’s economic projections tells a nuanced story. While inflation forecasts for 2025 were revised upwards, GDP growth projections also saw an upgrade, suggesting a robust economic outlook. The dot plot now indicates two rate cuts in 2025 instead of four, but the total projected cuts through 2027 decreased only by one, from six to five.

Powell’s communication style remained consistent with previous meetings, maintaining a cautious tone while softening some of the dovish language, without shifting towards a more aggressive stance. The reduction in projected rate cuts appears more like a timing adjustment than a fundamental change in policy direction.

A strategic perspective suggests that the market’s sharp reaction may present buying opportunities in US equities once volatility settles, potentially within the next few days to a week.

Technical Analysis

S&P 500

Image Source: TradingView

From a technical analysis standpoint, the S&P 500 is currently testing its support level ($5,879). Should this level hold, it would suggest that the market isn’t overreacting to the recent Fed rate cut, signalling stability despite the hawkish tone in the central bank’s outlook. A recovery from this support could pave the way for a potential rally back to all-time highs.

However, there is also the possibility that the S&P 500 could dip further to test a deeper support level of around $5,500. This could be a strategic move to capture liquidity before the market sets up for its next upward trend. Monitoring the market’s response to the Fed’s policy outlook is crucial, as it will provide insights into whether the market can sustain a recovery or if a deeper correction is necessary for a more stable rally.

DISCLAIMER

This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta Pro does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in traditional securities (such as forex currency pairs, stocks, bonds, and commodities) carries inherent risks, including potential loss of principal. Users are encouraged to carefully evaluate their financial objectives, conduct their own research, and seek independent financial advice before making any trading decisions. BitDelta Pro is not liable for any losses or damages resulting from actions taken in response to this communication.

Register an Account

Start your trading journey and explore limitless trading opportunities

Sign up today and gain access to global markets!

Register Now

;?>)