Table of Contents

Trump Presidency: Economic and Investment Prospects

5 MIN READ

Team BitDelta Pro • 11 Nov 2024

With Donald Trump securing another term as president, markets are likely to experience significant shifts in policy and economic strategy. While his administration is expected to drive short-term growth, the long-term impact could bring both opportunities and risks. Here are the key policies to prepare for his presidency and how they would affect the overall market.

Tax Policy: Economic Stimulus or Long-Term Strain?

Trump has signalled intentions to extend the Tax Cuts and Jobs Act (TCJA) of 2017, which reduced income tax rates for individuals and corporations. This extension could sustain lower tax rates and potentially boost corporate profits in the short term. Furthermore, it is anticipated that there will be additional corporate tax reductions and the exclusion of tips and overtime pay from taxation.

Impact: While tax cuts could provide a temporary boost to stock prices, particularly benefiting corporate earnings, the long-term effects remain uncertain. Rising deficits and reduced government revenue, compounded by an ongoing trade war with China, could weigh on the economy over time.

The Trade War with China: Disrupting Global Supply Chains

A cornerstone of Trump’s economic policy is his hardline stance on China. His administration is expected to continue implementing tariffs, possibly up to 60% on Chinese imports. This escalation of the trade war may further strain US-China relations, with China losing access to US markets and seeking alternatives in Southeast Asia. The ‘Tech War’ is also likely to intensify, particularly in semiconductors, quantum computing, and artificial intelligence.

Impact: Tariffs will disrupt US-China trade, potentially benefiting certain sectors in Southeast Asia while contributing to market volatility. The long-term effects on global supply chains could lead to shifts in manufacturing and trade patterns, causing ripple effects across markets.

Healthcare: A Shift in Policy and Impact on Pharma

Trump’s administration will likely focus on repealing and replacing the Affordable Care Act (Obamacare) with a new healthcare plan. Additionally, there is an expectation of an executive order aimed at reducing prescription drug prices under Medicare to make US drug costs more competitive with those in other developed nations.

Impact: While healthcare reforms may reduce government spending, drug price controls could exert pressure on pharmaceutical and biotech stocks. Investors in these sectors should be prepared for potential regulatory challenges as the healthcare landscape evolves.

Immigration: Labour Market Disruptions

Trump’s strict immigration policies include efforts to strengthen border security and significantly reduce the number of unauthorised immigrants. These measures could have a significant impact on industries reliant on low-wage labour, including construction, leisure, and service sectors.

Impact: Reduced labour supply may lead to labour shortages, hindering economic growth and driving up costs in certain industries. This could contribute to deflationary pressures and slow overall economic activity, potentially affecting productivity and GDP.

Energy: Prioritising Traditional Energy Sources

Trump’s energy policy will likely continue to favour traditional energy industries such as oil and nuclear power. Expect expedited approval for oil drilling permits and greater emphasis on natural gas exports. Additionally, Trump is expected to maintain his rejection of global climate change initiatives, including the US’ withdrawal from the Paris Agreement.

Impact: Traditional energy stocks, especially in the oil and nuclear sectors, are expected to benefit under Trump’s policies. Conversely, clean energy stocks could face increased pressure as the administration prioritises fossil fuels over renewable energy.

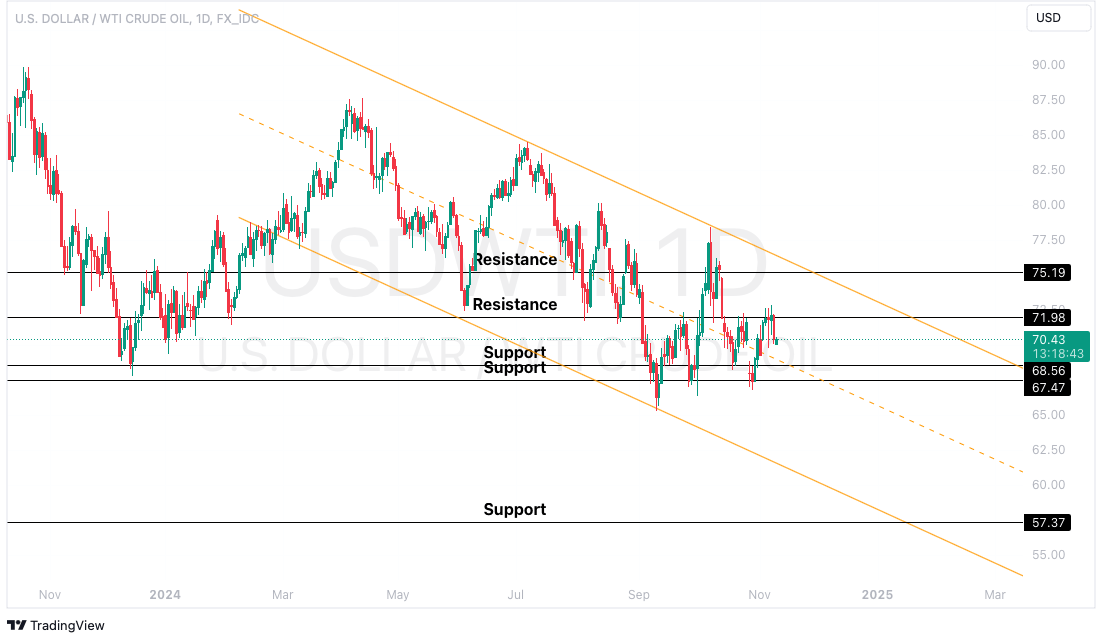

However, it’s important to note that while Trump’s energy policies may lead to an increase in domestic oil production, this could put downward pressure on oil prices in the long term due to higher supply.

Short-Term Growth, Long-Term Risks

Trump’s economic policies focus on stimulating short-term growth through tax cuts, corporate profit increases, and the expansion of the energy sector.

However, these measures present long-term risks, such as trade disruptions, rising inflation, and potential imbalances in the labour market. The combination of a trade war with China, stringent immigration policies, and aggressive fiscal stimulus could contribute to heightened volatility in global markets.

Asset Outlook

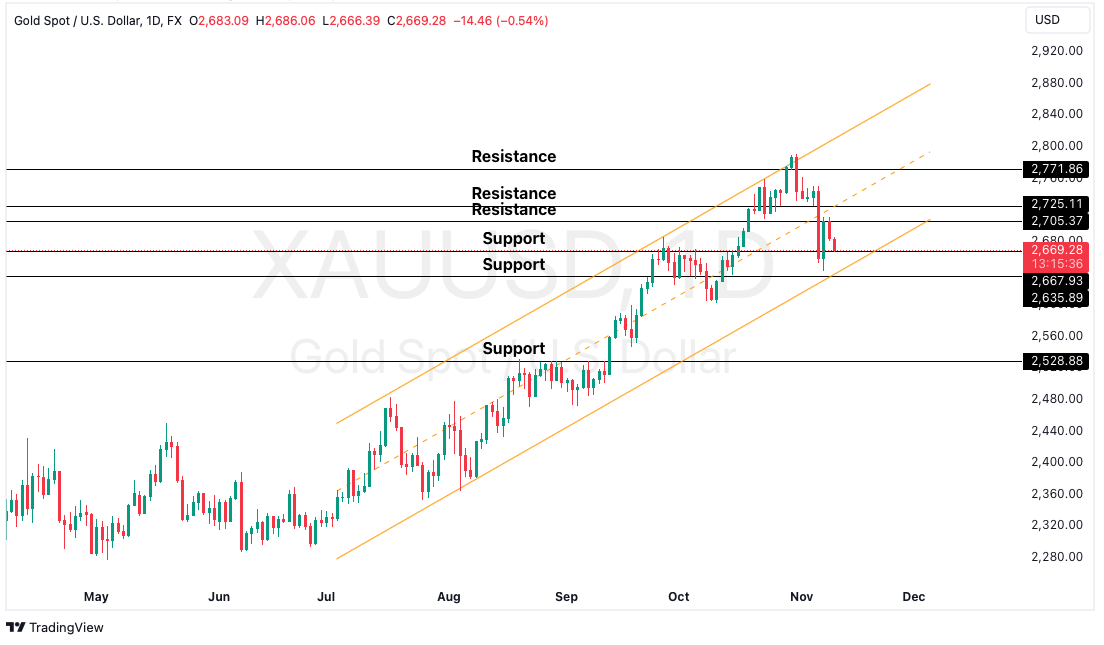

Gold

Sentiment: Bullish

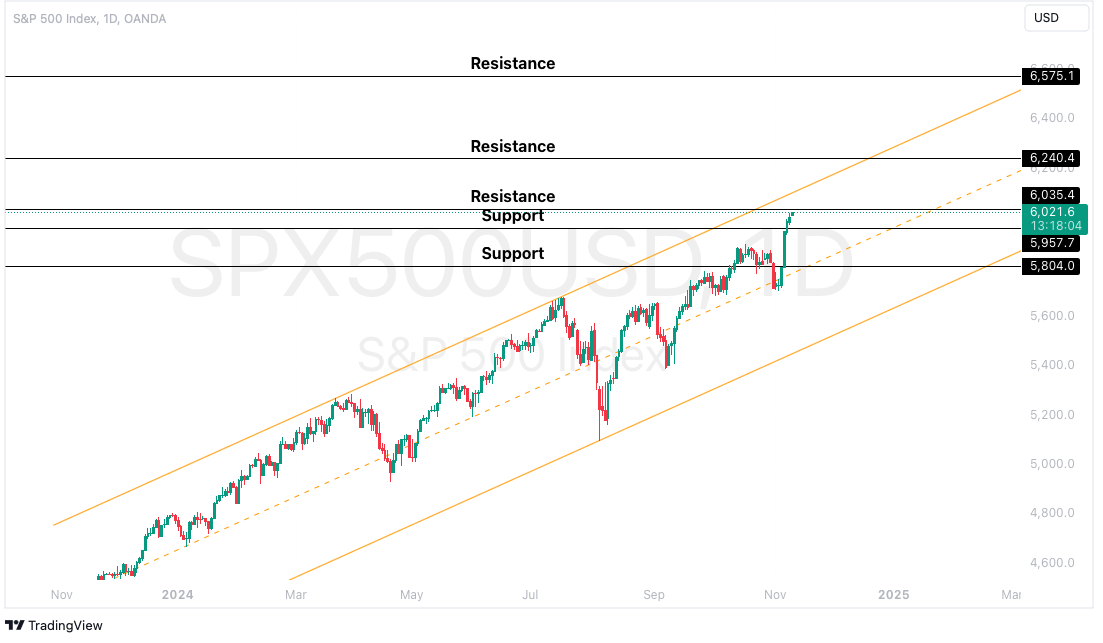

SPX500USD

Sentiment: Bullish

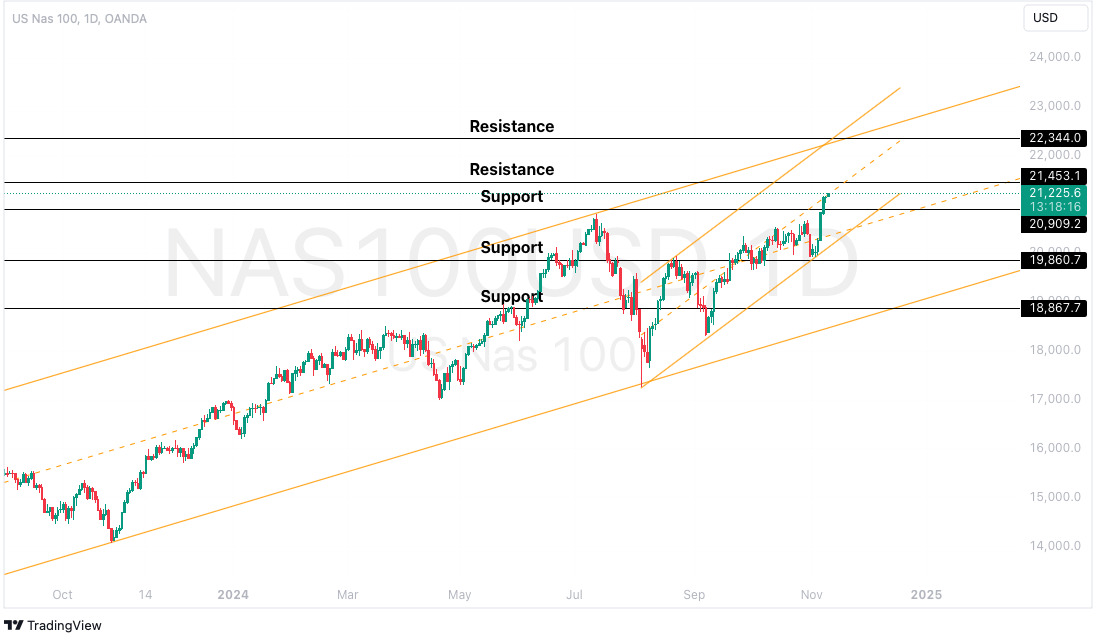

NAS100USD

Sentiment: Bullish

USDWTI

Sentiment: Bearish

DISCLAIMER

This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta Pro does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in traditional securities (such as forex currency pairs, stocks, bonds, and commodities) carries inherent risks, including potential loss of principal. Users are encouraged to carefully evaluate their financial objectives, conduct their own research, and seek independent financial advice before making any trading decisions. BitDelta Pro is not liable for any losses or damages resulting from actions taken in response to this communication.

Register an Account

Start your trading journey and explore limitless trading opportunities

Sign up today and gain access to global markets!

Register Now

;?>)