Key Updates

- In a long-anticipated announcement, President Trump declared reciprocal tariffs on 180 countries. Any country not covered in the list will now be subject to a default 10% tariff.

- The most heavily affected nations include China, the EU, Japan, Vietnam, and India. For China, these new tariffs are layered over pre-existing duties, resulting in an effective tariff rate of 54%.

- Auto import tariffs, expected to remain at 25%, will be officially announced later today.

- Baseline tariffs kick in at midnight this Saturday, while reciprocal tariffs are set to go live from April 9th, subject to further negotiations.

What is a Tariff?

A tariff is a form of tax levied on imported goods and services, usually borne by the buyer. This increases the base price of imports, making them less competitive when compared to domestic alternatives.

Governments typically impose tariffs for three key reasons:

- To protect new or struggling domestic industries.

- To reduce trade deficits.

- To boost government revenues.

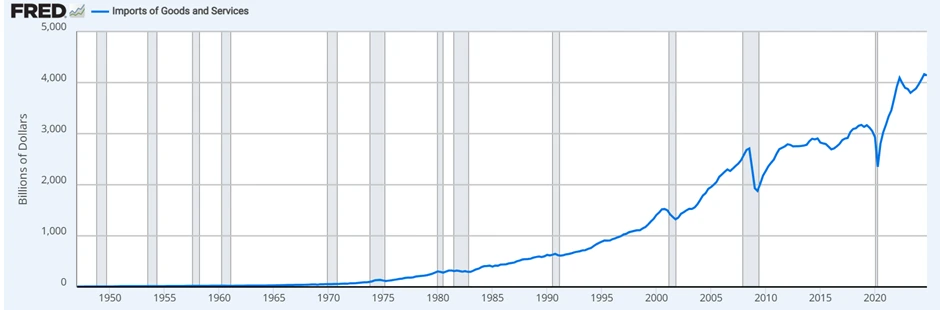

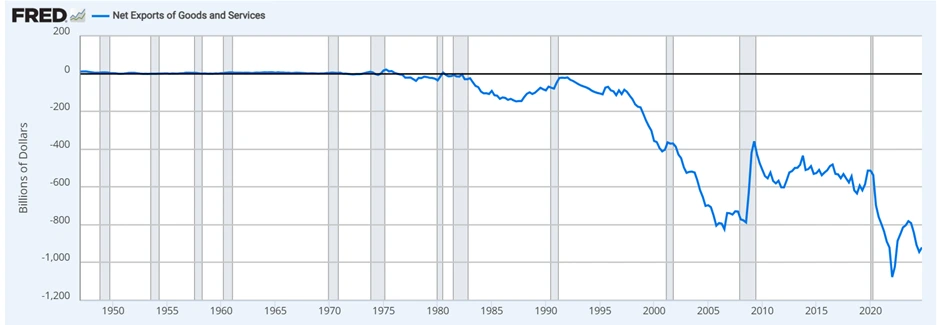

A trade deficit occurs when a country imports more than it exports. The United States, historically a net importer, runs a significant trade deficit.

This new reciprocal tariff policy is aimed at revitalising domestic industries (especially manufacturing) and narrowing the trade imbalance.

Will Tariffs Reduce the US Deficit?

Tariffs can sometimes help balance trade, but only under the right conditions:

- The domestic industries being protected must be capable of becoming competitive.

- The country must be able to produce at lower costs and deliver on quality.

However, when a country lacks cost competitiveness, tariffs often backfire. Prices rise across the board, triggering inflation, and diplomatic ties with trade partners may suffer long-term damage.

Why Now?

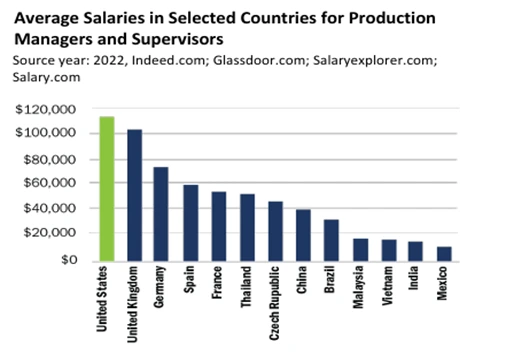

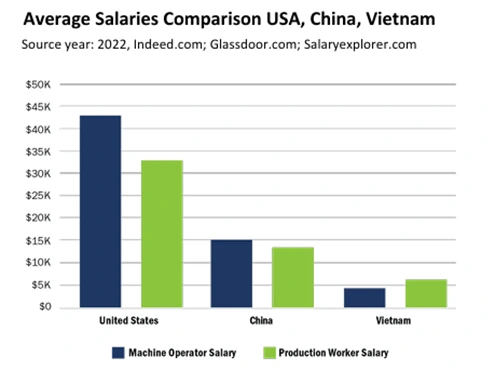

President Trump believes the US needs a manufacturing revival to regain jobs lost during decades of globalisation. Since the 1980s, many American companies have moved operations overseas, drawn by lower wages in countries like China, India, and South Korea.

This offshoring of labour, combined with the growing ease of global trade, has deepened the US’ trade deficit over time. Today, imported goods make up nearly half of all goods purchased in America.

Magnitude of Imports (1950–2024)

Magnitude of Net Exports (1950–2024)

Source: FRED | For Illustrative Purposes Only

Trump’s Tariff Formula

While most tariff structures are the result of complex multilateral discussions, the Trump administration opted for a more formulaic approach.

A flat 10% tariff was imposed on all countries. Then, for countries with which the US has a deficit, the following formula was used:

(Trade Deficit / Imports) ÷ 2

This figure, according to the administration, reflects what the US believes it is being “charged” by others—and applying half of that as a tariff is “reciprocal”.

However, this formula was inconsistently applied. Even countries like the UK, where the US runs a trade surplus, were hit with a flat 10% tariff.

Will It Work?

In short, probably not—mainly due to America’s lack of cost competitiveness. A 2022 report from the Reshoring Institute highlights how expensive US manufacturing labour is compared to peers.

This makes it difficult for domestic producers to offer goods at prices competitive with imports. Without affordable substitutes, higher import tariffs mean consumers pay more, particularly impacting lower-income households. Tariffs act as a regressive tax in this context.

Given the US economy’s reliance on imports for household consumption, these tariffs are expected to drive inflation higher.

Diplomatic Fallout

Besides economic consequences, diplomatic tensions are flaring. Trade partners like Canada, Mexico, and the EU have retaliated with tariffs of their own, making US exports pricier. In some markets, American products are being actively boycotted—further worsening the trade imbalance.

Economic Impact

As net exports decline, aggregate demand is expected to fall, dragging down real GDP growth. While some fear a recession, analysts highlight the underlying strength of the US labour market, citing low layoffs and steady job creation.

Fed Chair Jerome Powell has stated that soft sentiment data shouldn’t be overinterpreted. Unless consumer spending collapses, a mild slowdown—not a recession—is more likely.

Technical Analysis

Markets have entered a risk-off mode in response to these announcements. Equities are facing downward pressure, while safe-haven assets like US Treasuries, the Japanese yen (JPY), the Swiss franc (CHF), and precious metals are becoming more attractive.

With inflation set to rise, the Fed is unlikely to lower rates in the near term. Quantitative tightening is expected to continue, albeit cautiously.

Volatility will likely remain high until April 9th, when the reciprocal tariffs go into effect and new rounds of negotiation begin. Until then, equities may continue to correct.

S&P 500 Trend

Source: TradingView | For Illustrative Purposes Only

US 10-Year Treasury Trend

Source: TradingView | For Illustrative Purposes Only

USD Index (DXY) Trend

Source: TradingView | For Illustrative Purposes Only

As these charts suggest, US equities and the dollar may weaken further, while treasuries present a solid opportunity in this volatile environment.

Policy Gamble or Strategic Reset?

The introduction of reciprocal tariffs marks a bold and controversial step in the Trump administration’s economic policy. While the intention to reduce the trade deficit and restore domestic industry is clear, the lack of cost competitiveness, combined with the global reliance on American imports and exports, casts doubt on the long-term success of this strategy. Rising prices, strained trade relations, and increased market volatility are immediate consequences.

Whether this is a necessary disruption for a future reset or a policy misstep with lasting damage remains to be seen. As global markets await further negotiations post-April 9th, all eyes will be on how the US economy—and its trading partners—responds.