Strong Jobs Report, Rising Yields, and Market Volatility

3 MINS READ

Team BitDelta Pro • 13 Jan 2025

The recent US employment report highlighted an unexpectedly robust labour market, with 256,000 new non-farm jobs added, surpassing the anticipated 165,000. The unemployment rate declined to 4.1%, better than the expected 4.2%, while the labour force participation rate remained steady at 62.5%.

Wage growth, a key metric for inflation, also came in as expected. Average hourly earnings rose by 0.3% month-over-month and 3.9% year-over-year, slightly below the anticipated 4%. This suggests that wage-driven inflation isn’t spiralling out of control, which relieves policymakers.

When Good News Triggers Market Uncertainty

At first glance, strong job numbers and a robust economy seem like positive developments. However, this phenomenon, often referred to as “Good News for Economy is Bad News for Stocks” in financial terms, happens when strong economic data unexpectedly leads to market declines.

- The Fed’s Dilemma: A strong economy means the Fed has less pressure to cut interest rates. Higher interest rates are typically used to cool down an overheating economy, but they also increase borrowing costs for businesses and consumers. Given the current strength of the job market, the Fed is likely to hold off on rate cuts—something the market had been anticipating, with expectations now pointing to no rate cuts until at least October this year.

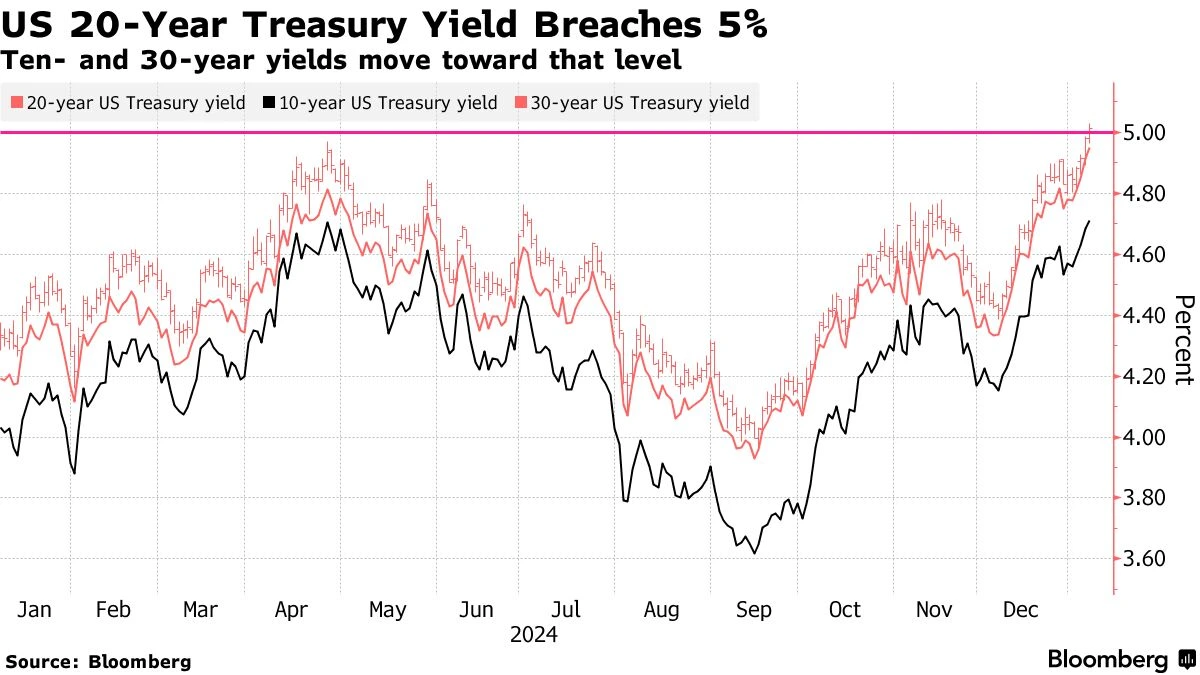

- Bond Yields Rise: When the Fed signals that it won’t cut rates soon, bond yields tend to rise. This happens because higher interest rates make existing bonds less attractive, causing their yields to climb. The 10-year treasury yield, a key benchmark for borrowing costs, has recently risen and is now approaching 5%. This surge reflects shifts in economic conditions and monetary policy, driven by concerns over inflation and escalating government debt. If this trend persists, it could materially shift the investment landscape, catching many investors off guard.

- Stock Market Pressure: Higher yields mean higher borrowing costs for companies, particularly smaller firms that rely heavily on debt. This often weighs on stock markets, especially small-cap indices like the Russell 2000. In short, good economic news can lead to market sell-offs as investors recalibrate their expectations for rate cuts.

What Lies Ahead? Key Trends to Watch

As the financial landscape evolves, several factors will shape the markets in the coming months:

Bond Yields: How High Can They Go?

The recent surge in bond yields has left investors wondering just how much higher they can climb. The 20-year treasury yield recently broke past 5%, a level not seen since 2023, while the 10-year and 30-year yields are inching closer to their 2023 peaks. This upward trend is being driven by fears of inflation, concerns over widening deficits, and the resilience of the US economy.

Yields have been on the rise since the Fed began its rate-cutting cycle in September. The combination of a strong economy and President-elect Donald Trump’s victory has only accelerated this trend, pushing the 10-year yield more than 100 basis points higher than before the Fed’s first cut.

While there may still be room for yields to rise, historical patterns and strong demand for safe-haven assets like treasuries could limit their ascent. The Federal Reserve’s next moves will be critical—any signals of rate hikes could push yields even higher, while a dovish pivot might help stabilise them.

The US Dollar’s Strength: A Two-Sided Coin

A strong US economy and rising bond yields typically boost the US dollar, but this strength comes with trade-offs. A stronger dollar makes American exports more expensive, potentially hurting US companies that rely on global markets. It also tends to draw capital away from emerging markets, as investors chase higher returns in the US. Additionally, a robust dollar often puts downward pressure on commodity prices, including gold, which could face further challenges.

Global Ripples: Japan in the Spotlight

The impact of a stronger dollar and higher US yields extends far beyond American borders. One economy to watch closely is Japan. A weaker yen, driven by a stronger dollar, could push inflation higher in Japan, potentially forcing the Bank of Japan to raise interest rates sooner than expected. This would mark a significant shift in Japan’s monetary policy, with ripple effects across global markets.

Beyond the Short-Term Noise

While the immediate reaction to strong job data might trigger a market sell-off, there’s a positive side to this story. A robust economy lays the foundation for stronger corporate earnings, which are the ultimate driver of stock prices over the long term. Yes, the market may see fluctuations in the short term as investors adjust to delayed rate cuts, but for those who believe in the resilience of the US economy, the long-term outlook remains promising. For long-term investors, this could even be an opportunity to buy at lower prices. While markets may fluctuate, economic strength tends to win out in the long run.

DISCLAIMER

This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta Pro does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in traditional securities (such as forex currency pairs, stocks, bonds, and commodities) carries inherent risks, including potential loss of principal. Users are encouraged to carefully evaluate their financial objectives, conduct their own research, and seek independent financial advice before making any trading decisions. BitDelta Pro is not liable for any losses or damages resulting from actions taken in response to this communication.

Register an Account

Start your trading journey and explore limitless trading opportunities

Sign up today and gain access to global markets!

Register Now

;?>)