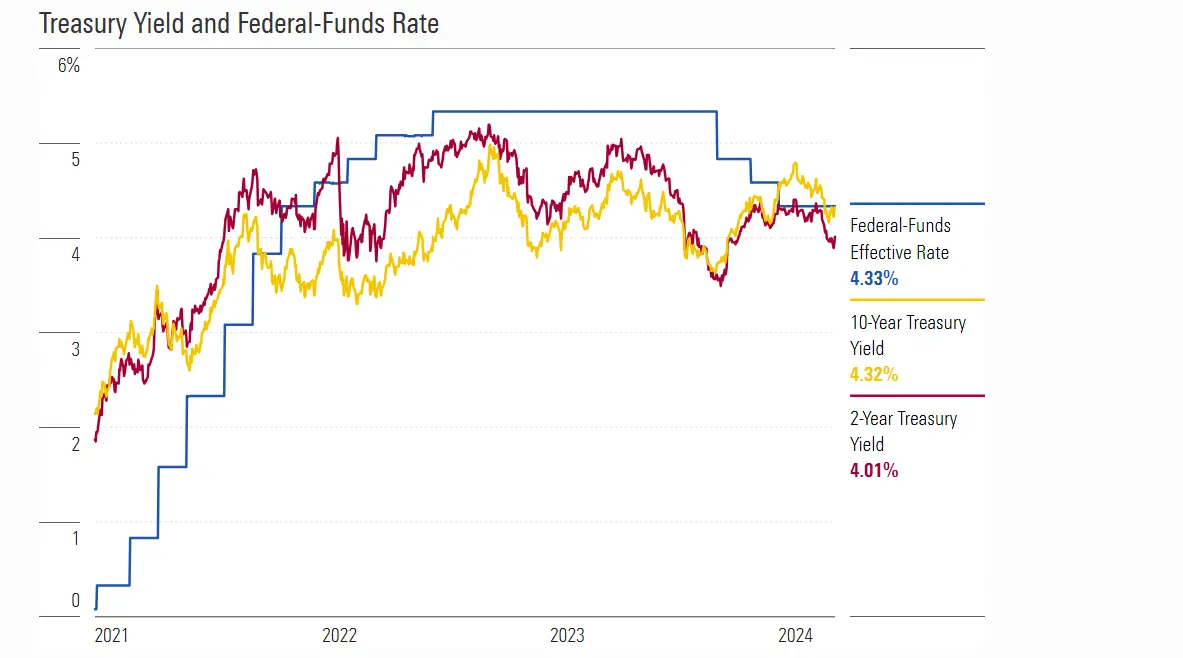

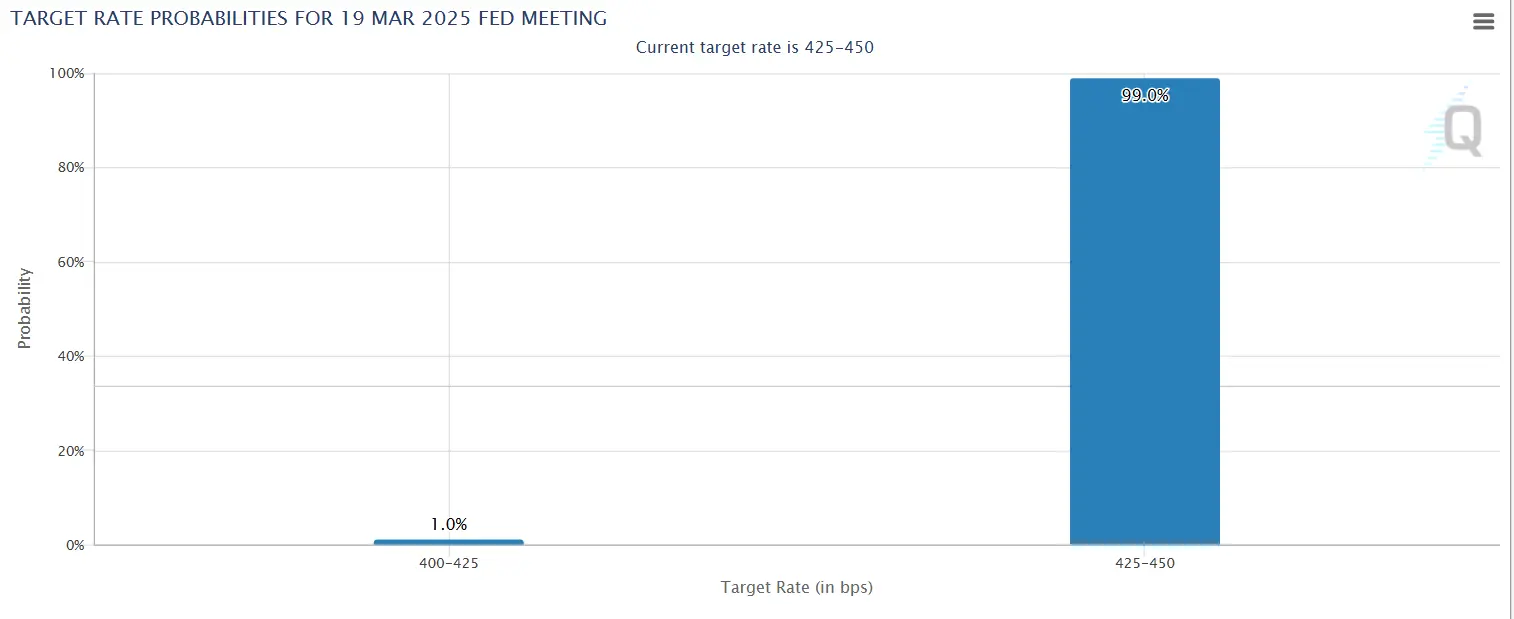

The Federal Reserve is set to announce its latest interest rate decision on March 19th, with markets widely expecting no changes to the current 4.25%-4.50% target range. Given the current economic landscape, investors and policymakers are weighing inflation concerns against signs of slowing growth.

The chart above shows how the Fed’s regime has changed over the past three years.

Balancing Inflation and Recession Risks

Recent economic data presents a mixed picture. Inflation has remained stubbornly high, standing at 3.1% (accounting for food and energy) in February, though the full impact of newly imposed tariffs is yet to be reflected in consumer prices. At the same time, economic growth is showing signs of slowing, with declining consumer confidence, weaker retail sales, and a slight uptick in unemployment (4.1% in February vs. 4.0% in January). Inflation metrics shown below:

| Metric | February | January | February Forecast |

| CPI y/y (without energy and food) | 2.8% | 2.9% | 3.0% |

| Core PPI m/m | -0.1% | 0.3% | 0.3% |

| PPI m/m | 0% | 0.3% | 0.4% |

The Federal Reserve faces a critical decision: keep rates steady to maintain inflation control or begin cutting to stimulate economic activity. With the US debt-to-GDP ratio reaching 122.3%, lower interest rates could ease debt servicing costs, but they also risk fuelling further price increases.

What the Market Predicts

Fed Funds Futures currently indicate a 99% probability that rates will remain unchanged, implying an effective Fed Funds Rate of 4.33%. This suggests that the market does not anticipate a rate cut in the immediate term.

Several factors will play a role in shaping the Fed’s stance:

- Treasury Secretary Bessent has advocated for rate cuts to stimulate consumer spending and ease debt burdens.

- President Trump has hinted at the possibility of a recession, potentially as a strategy to push for lower rates.

- Fed Chair Powell and the FOMC maintain independence in monetary policy, prioritising inflation control over political pressures.

- Economic Projections and Meeting Minutes from the Fed will provide insights into future policy direction, particularly regarding inflation expectations and potential fiscal policy changes.

Market Implications

If the Fed holds rates steady, equity markets could continue their bearish trend, as investors anticipate higher borrowing costs. A rate cut, though unlikely, could provide short-term relief but may also exacerbate inflationary pressures.

Final Thoughts

With inflation still a concern and economic uncertainty looming, the Fed is likely to take a cautious “wait-and-see” approach. While rate cuts may be necessary later in the year, the decision on March 19 is expected to maintain the status quo, allowing for further assessment of economic conditions before any major policy shifts occur.