As a currency trading novice, you might be under the impression that the Canadian dollar (CAD) has been struggling against the US dollar (USD) over the past few years. However, the current macro reality may challenge this assumption as several key factors suggest the CAD might be ready for a rebound. Let’s break down what’s happening in simple and comprehensible language.

Despite what you may have heard, Canada currently has the second-strongest economy among the G7 countries (which include the US, UK, France, Germany, Italy, and Japan). The Canadian economy grew by 1.3% over the past year, which might not sound like much, but it is impressive in the world of major economies!

Why Has the Canadian Dollar Been Weak Until Now?

The CAD has performed poorly against the USD for a few main reasons:

- The US economy has been growing faster than Canada’s.

- Recent trade tensions have created uncertainty.

- Interest rate cuts by Canada’s central bank typically weaken the currency in the short term.

Three Simple Reasons Why Things Might Change

Interest Rates and Bonds are Shifting in Canada’s Favor

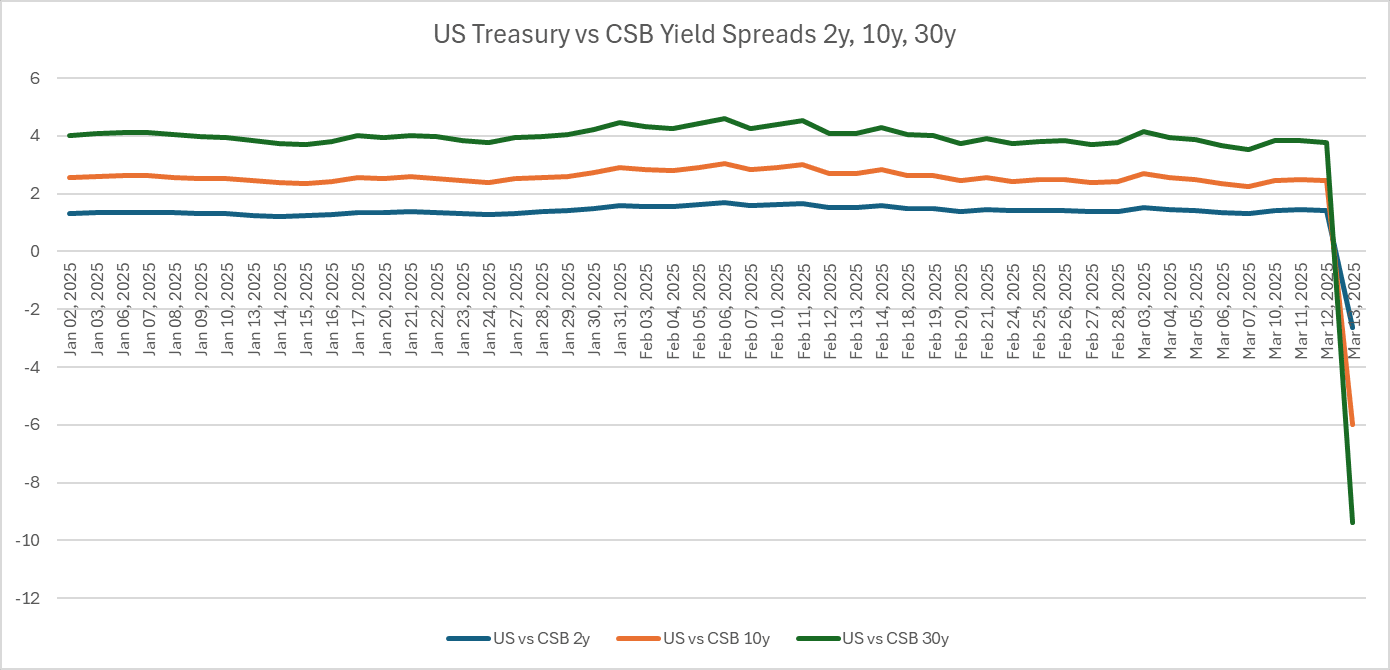

When you hear about “bond yields”, think of them as the interest rates governments pay investors who buy their debt. Higher yields usually attract more investors, which increases demand for that country’s currency.

What’s happening now: For the first time this year, Canadian government bonds are paying higher interest than US government bonds. As a result, investors might start buying more Canadian dollars to invest in these bonds.

Simple explanation: The lines crossing means Canadian bonds now pay better than US bonds

New Leadership Could Boost Confidence

Canada is expected to get a new Prime Minister – Mark Carney – who previously led the Bank of Canada and the Bank of England (two major central banks). He’s known for:

- successfully guiding Canada through the 2008 global financial crisis as the head of the Bank of Canada.

- being the first foreigner to lead the Bank of England’s monetary policy committee.

- successfully leading the UK through Brexit and its subsequent adverse economic impact.

When countries have stable, experienced leadership with business-friendly policies, their currencies often benefit.

Technical Signs Point to a Potential Turnaround

Even if you don’t understand all the technical analysis terms, the simple version is this: the momentum pushing the US dollar up against the Canadian dollar is starting to slow down. This often happens before a currency changes direction.

What About Those Tariffs From the US?

Yes, the US has placed a 25% tax on most Canadian goods (and 10% on energy exports), which isn’t great for Canada. However:

- Canada has placed its own tariffs on US goods in response.

- Canada supplies critical energy resources that the US needs.

- The new leadership plans to use this energy relationship as leverage in negotiations.

What This Means for New Traders

If you’re starting currency trading, the USD/CAD pair might be worth watching over the coming months. Here’s why:

- Potential opportunity: Technical indicators suggest the USD/CAD might be ready to fall (meaning the Canadian dollar would strengthen).

- Clear support level: Watch the price level of 1.41562—if the USD/CAD drops below this, it could confirm the downward trend.

- Multiple supporting factors: When economic data, interest rates, and technical signals all point in the same direction, it often makes for a stronger trend.

Getting Started

If you’re interested in trading based on this outlook, BitDelta Pro offers:

- Simple guides to help you understand currency pairs.

- User-friendly tools for setting up trades with proper risk management.

- Regular updates on how these economic factors are developing.

Remember that all trading involves risk, and currency movements depend on many factors that can change quickly. Start with small positions, use stop-losses to protect your investment, and never trade with money you can’t afford to lose.