The AI Battle Heats: DeepSeek from China Takes on America

4 MINS READ

Team BitDelta Pro • 27 Jan 2025

The US stock market took a surprising downturn this Monday, with one of the key reasons, aside from expectations that the Fed will not cut interest rates this Wednesday, being the unexpected rise of Deepseek. This development has sent shockwaves through the US market today, particularly impacting major indices like the S&P 500 and Nasdaq.

DeepSeek’s Cost-Effective GPT-4 Alternative

The AI industry experienced a shocking moment with the launch of Deepseek’s latest model last Friday. This Chinese AI company has stunned the industry by proving that cutting-edge AI development can be achieved at a fraction of the traditional cost. Their model, which matches GPT-4’s capabilities in coding, problem-solving, and multilingual communication, was developed for just $6.7 million—a dramatic contrast to OpenAI’s reported billions in total investment. The implications for the AI landscape are nothing short of astounding.

Who is DeepSeek Anyway?

DeepSeek, originally linked to High-Flyer Capital Management, a Chinese quantitative hedge fund, brings a non-traditional perspective to AI development. This background in finance, particularly in quantitative trading, has endowed DeepSeek with a unique approach to resource management. By leveraging the computational infrastructure initially built for trading, DeepSeek has developed AI models focusing on cost efficiency, disrupting the conventional high-cost model of AI development prevalent in the industry.

The company offers their R1 model as an open-source solution, which contrasts with OpenAI’s subscription-based model that charges enterprises $200 per month. Additionally, ChatGPT Plus, which costs $20 per month, is now being offered for free (it has just been re-offered), although its performance is lower than that of ChatGPT Pro (the O1 model).

AI Development Cost Comparison

The cost differences among major AI developments are significant:

- OpenAI: Founded 10 years ago, OpenAI has 4,500 employees and invests at least $5 billion annually in the development of AI models.

- DeepSeek: Established 2 years ago, DeepSeek employs only 200 people and has spent approximately $6.7 million on development.

- Google/Gemini: The company has invested around $500 million in its Gemini Ultra project.

- Anthropic (Claude): Their reported expenditure is between $50 million and $100 million.

Why is DeepSeek’s Cost So Low?

The next question is: How does DeepSeek keep its costs so low? The answer lies in their innovative approach. Rather than following the traditional AI development methods, DeepSeek has adopted a technique known as MoE (Mixture of Experts). When a question is posed to DeepSeek, it first determines which expert model is best suited to provide the optimal answer. For example, if a financial question is asked, the model activates its financial expert and deactivates the other expert models.

This approach allows DeepSeek to reduce costs significantly by only activating the relevant model for each specific query, rather than running multiple models simultaneously. Interestingly, Deeps EEK’s latest version relies on AMD graphics processing units (GPUs) rather than the industry-standard NVIDIA chips. This shift in hardware could raise the question: Can AI models be developed effectively using hardware from companies other than NVIDIA?

DeepSeek’s AI capabilities currently cover a wide range of tasks, from simple mathematics to calculus, showcasing its strong logical reasoning abilities. In addition to minimising development costs, DeepSeek has further disrupted the US AI market by offering its model at a fraction of the price—hundreds of times cheaper.

Rather than developing the model exclusively in-house, DeepSeek has chosen to make it open-source, inviting developers worldwide to build upon and extend the technology. This approach has helped DeepSeek save enormous costs, allowing other developers to contribute to the model’s development, unlike American companies that bear the entire development cost internally. With significantly lower development costs, DeepSeek can afford to offer its model at a much lower price point.

Strategic Timing and Market Impact

DeepSeek’s launch timing seems strategically poised to challenge the US AI strategy. Just days after Trump announced a $500 million AI investment plan, aimed to make America the global AI leader, DeepSeek revealed its groundbreaking model. This raises questions: Was it a deliberate move to counter US ambitions, or simply a coincidence, aligning with traditional Chinese business practices before the Chinese New Year? While it could be seen as a bold response to the US AI claims, the true strategic intent behind the timing remains unclear. However, what’s undeniable is its significant impact on the market.

Hardware Market Implications

NVIDIA’s market position is under new scrutiny as DeepSeek showcases effective AI development using alternative hardware solutions. By utilising Huawei chips and AMD GPUs instead of relying solely on high-end NVIDIA GPUs, DeepSeek’s approach raises questions about the future hardware requirements for AI development. On top of that, NVIDIA recently released a supercomputer designed for public use, which is unusual for the company, as they have typically not focused on supercomputers. This move could suggest that NVIDIA is aware of emerging trends in AI hardware, possibly in response to developments like DeepSeek’s, signalling a shift in the competitive landscape.

Market Response

Current market dynamics show increasing uncertainty around traditional AI valuations. OpenAI’s $86 billion valuation faces new scrutiny as DeepSeek demonstrates similar capabilities at minimal cost. NVIDIA’s stock performance reflects growing investor concern about long-term hardware demand. Furthermore, Sam Altman has quickly announced various roadmaps in response to the buzz surrounding DeepSeek’s efficiency, aiming to reassure investors and the market of OpenAI’s continued innovation and leadership. Similarly, Mark Zuckerberg has made announcements regarding the next steps for Meta AI, emphasising Meta’s commitment to advancing AI technology and maintaining its competitive edge in the market. These rapid responses from industry leaders highlight the pressure to adapt and innovate amidst new competitive challenges.

Forward-Looking Indicators

Critical areas for market monitoring:

- NVIDIA’s data centre segment performance

- AI startup valuation trends

- Industry adoption of efficient development methods

- Strategic responses from major tech companies

Future Market Outlook

DeepSeek’s cost-efficient AI development represents a notable paradigm shift, suggesting that innovation in AI may no longer be tied to excessive capital deployment. This development could lead to broader market changes, including altered investment strategies, revised corporate approaches to AI spending, and heightened scrutiny of existing valuations. For market participants, the key questions will centre on whether DeepSeek’s model sets a new standard for the industry and how established players adapt to this potential disruption.

Technical Analysis

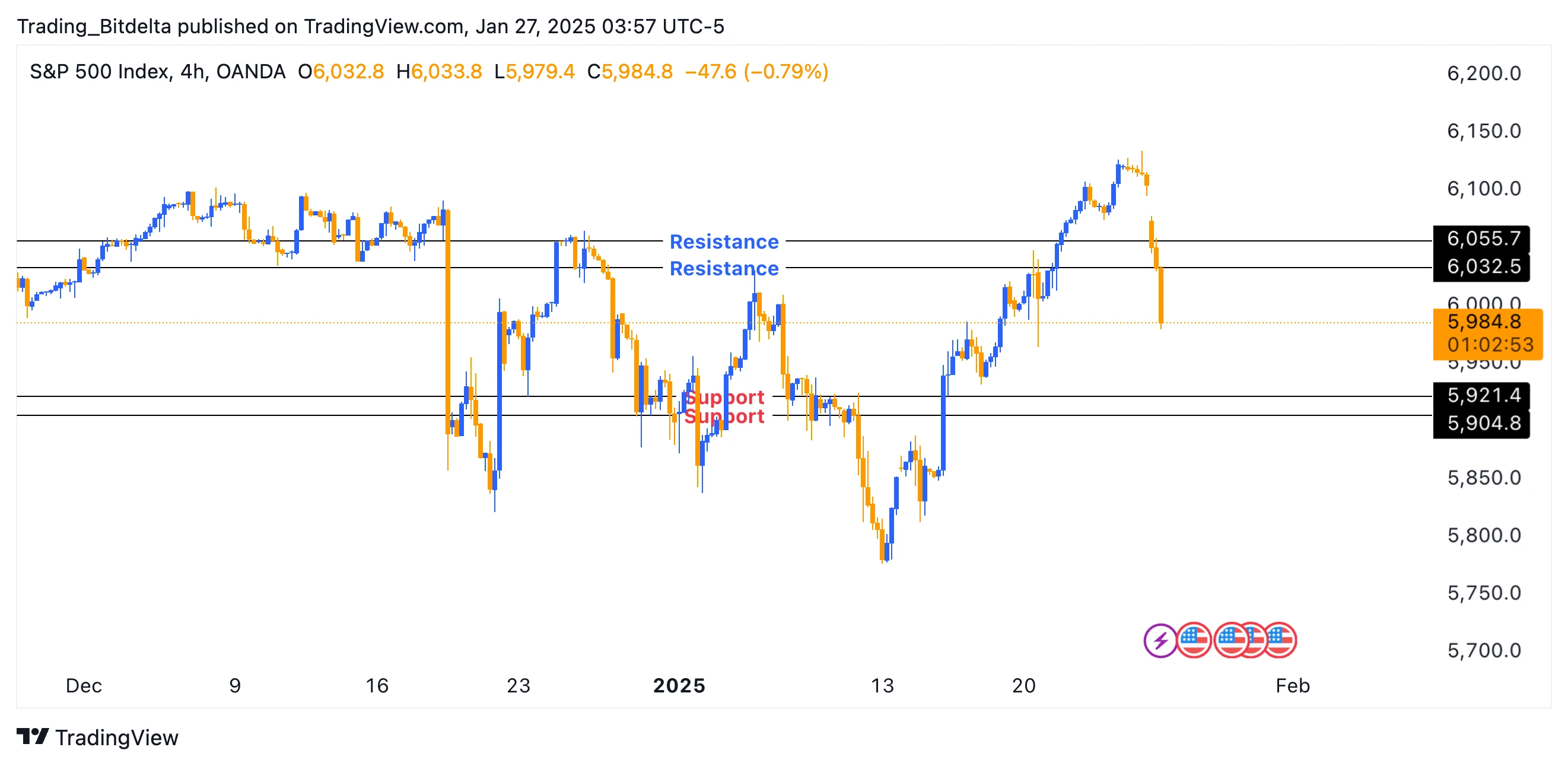

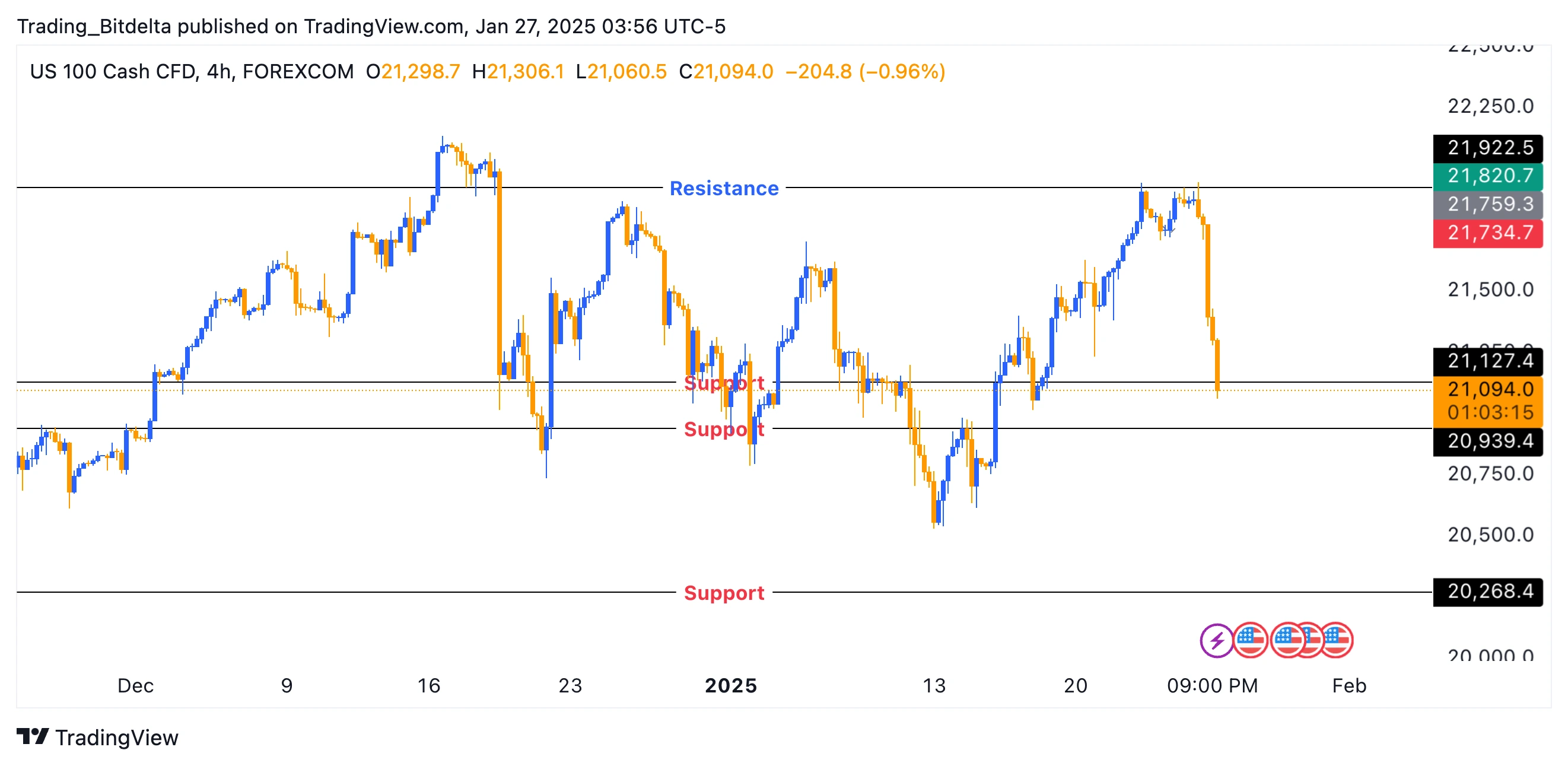

Following the market reaction to DeepSeek’s disruptive AI launch, major US indices like the S&P 500 and NASDAQ 100 futures face heightened volatility. This Monday’s market open observed a sharp decline, partly influenced by expectations surrounding the Fed’s interest rate decisions and DeepSeek’s sudden rise as a significant challenger in the AI sector.

S&P 500

Image Source: TradingView | For Illustrative Purposes Only

NASDAQ 100

Image Source: TradingView | For Illustrative Purposes Only

DISCLAIMER

This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta Pro does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in traditional securities (such as forex currency pairs, stocks, bonds, and commodities) carries inherent risks, including potential loss of principal. Users are encouraged to carefully evaluate their financial objectives, conduct their own research, and seek independent financial advice before making any trading decisions. BitDelta Pro is not liable for any losses or damages resulting from actions taken in response to this communication.

Register an Account

Start your trading journey and explore limitless trading opportunities

Sign up today and gain access to global markets!

Register Now

;?>)