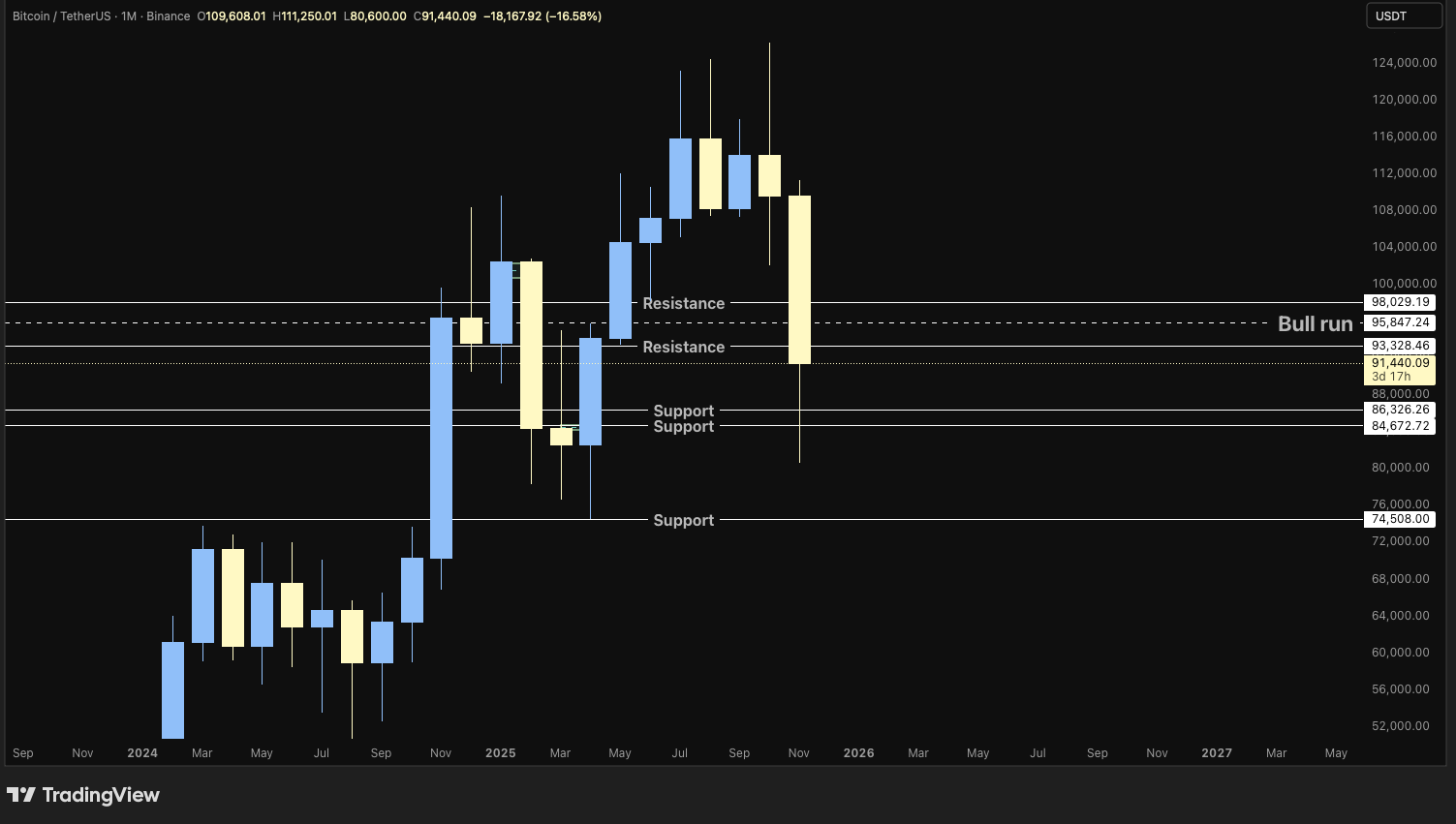

Bitcoin trades near the $86,000 support level, consolidating within a well-defined range. Monthly structure is forming between $84,672 and $93,300. Reclaiming $93,300 before the monthly close is critical to maintaining the broader bull trend; failure could open risk toward $74,500. Sentiment is weighed by corporate-proxy weakness (e.g., MSTR), partially offset by inflows into spot ETFs. Holiday-week liquidity is thin, limiting conviction. The MSCI/Nasdaq MSTR decision on January 15, 2026, remains a key potential catalyst for volatility.

Key Levels: Support at 86,326.26 │ Resistance at 92,328.46 / 98,029.19

Investor Takeaway: Constructive base intact; upside attempt toward R1 likely, but confirmation depends on volume returning post-holiday.