Oracle reported earnings yesterday with poor market reaction. Quarter showed headline EPS beat driven by massive AI/cloud backlog and one-off Ampere gain, but revenues missed, CapEx exploded, free cash flow went deeply negative. Stock sold off on fears AI build-out is outrunning near-term returns—fundamentals show strong AI demand locked in, but print shows “good growth, bad cash/margins and guide.” Q2 CapEx hit ~$12B with full-year guidance jumping to ~$50B due to front-loaded data center spend. Management acknowledged investor concern but argued that given committed RPO and expected AI demand, Oracle can fund build-out with less external capital than analysts fear. Critical question: Growth in RPO is laughable because WHO WILL PAY FOR THIS? Post-earnings call, Nasdaq fell 1.5% with futures currently trading red.

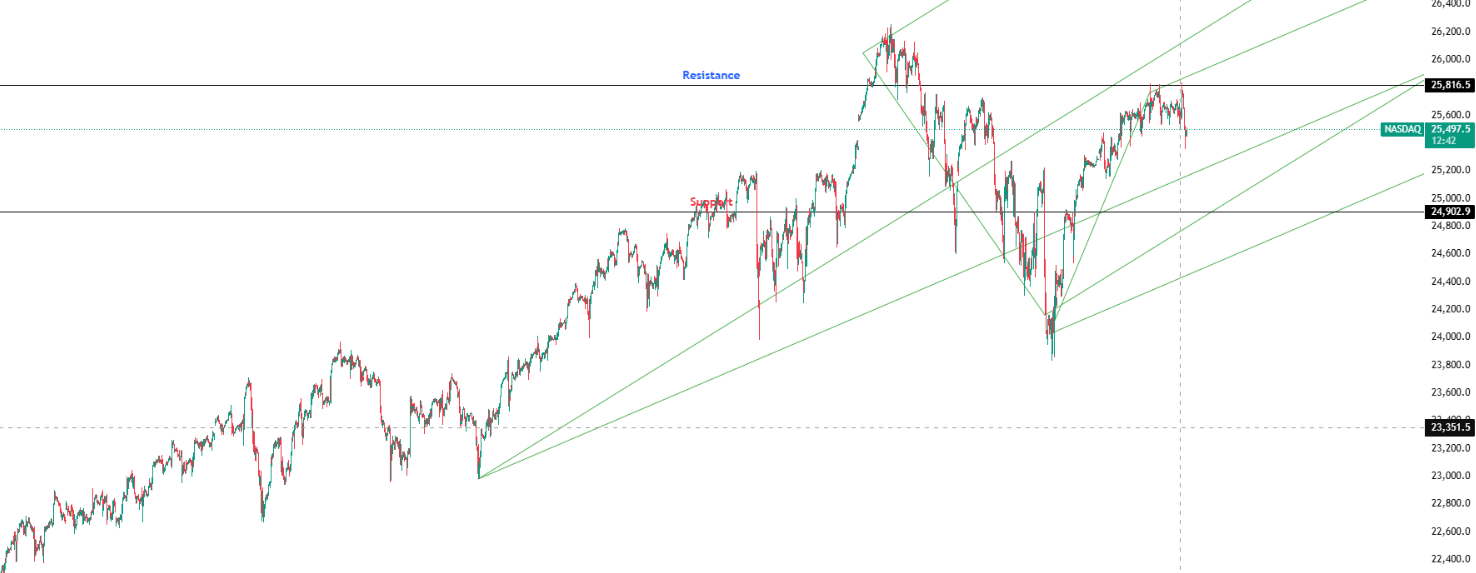

Key Levels: Support at 24,902.90 | Resistance at 25,816.50

Investor Takeaway: RSI and MACD show bearish momentum despite Fed tailwinds; credit concerns regarding Oracle are necessary for markets to address, further corrections expected unless positive economic data arrives soon.