As US yields stay elevated, Euro showed strength and appreciated, touching R1 before retracing yesterday. Somewhat better JOLTS report helped USD strength, though elevated yields likely to keep USD strength in check. ECB President Lagarde pointed toward rate hike in coming cycles to control inflation. Monetary policy divergence between two entities likely to lead to USD showing strength considering systematic advantages.

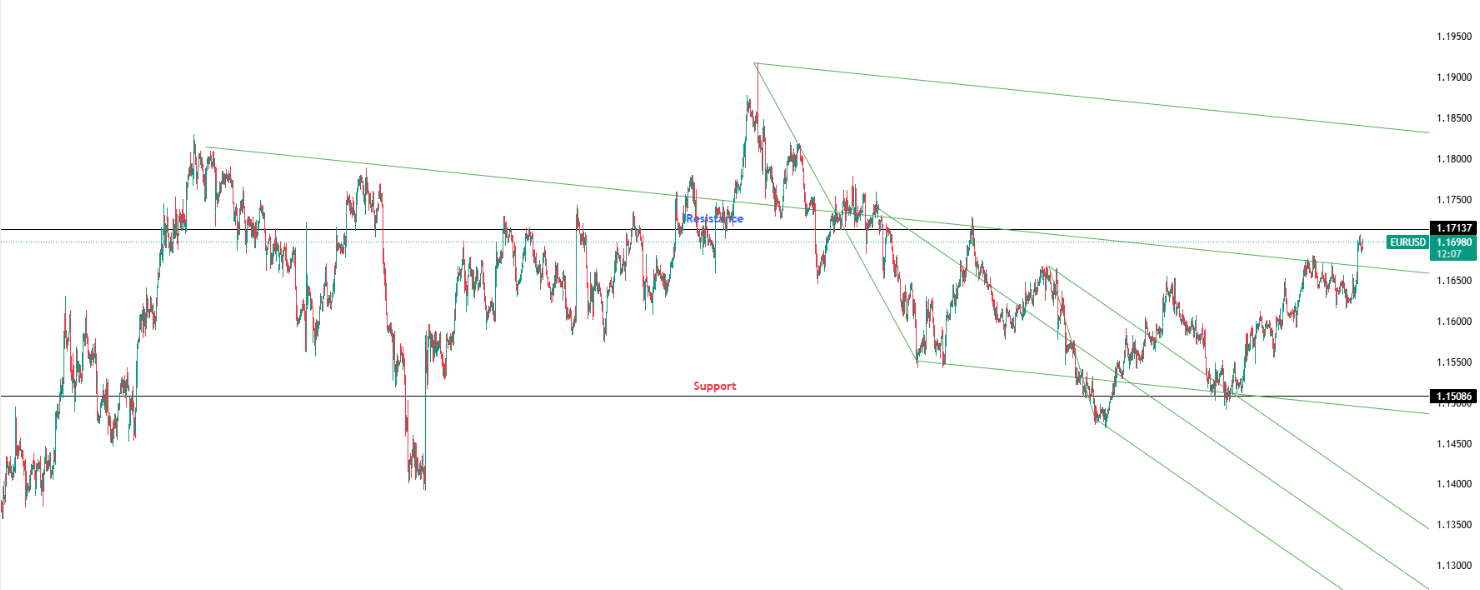

Key Levels: Support at 1.15086 | Resistance at 1.17137

Investor Takeaway: R1 rejection confirms resistance holding; ECB-Fed divergence (hikes vs hawkish cuts) creates medium-term dollar strength thesis despite near-term yield pressures.