EUR/USD maintains a cautiously bullish bias as elevated yields have failed to meaningfully support the USD. The pair broke above R1 before retracing, with weekly unemployment claims spiking and flows rotating away from the dollar. A mildly stronger JOLTS print provided temporary support, but USD strength remains capped by labor-market deterioration. Lagarde’s comments on potential ECB hikes add a hawkish anchor for the Euro.

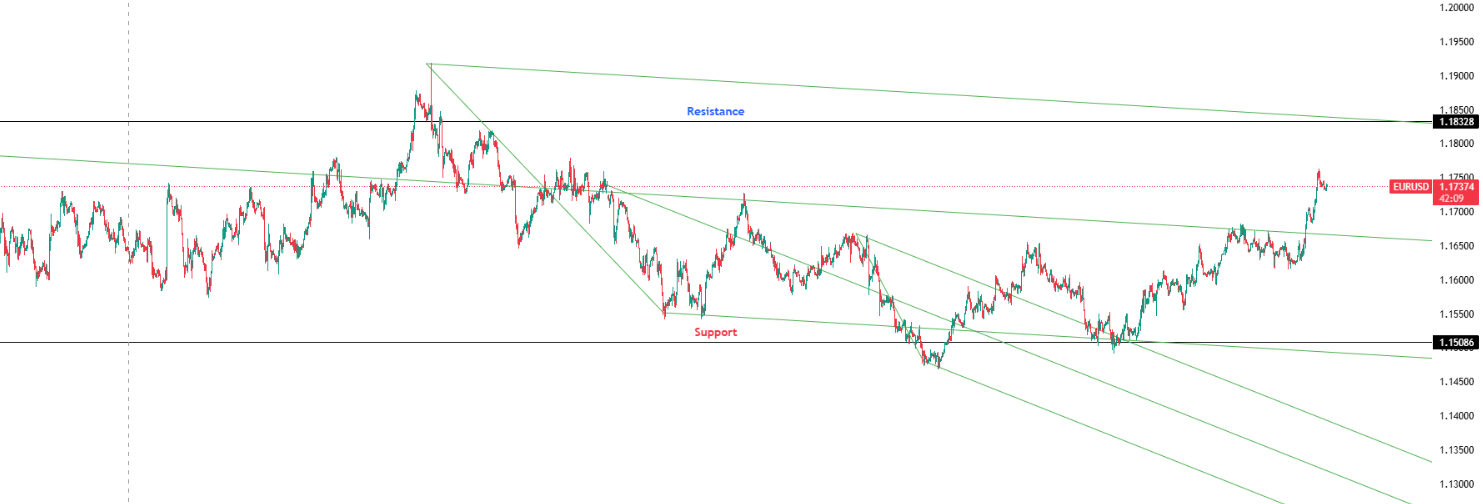

Key Levels: Support 1.15086 | Resistance 1.18328

Investor Takeaway: Euro gains likely persist near-term, though elevated resistance implies a consolidation or breakout inflection.