Outlook: Cautiously Bearish | Timeframe: 1 Day

The euro appreciated last week despite elevated US yields, reflecting short-term USD fatigue. A marginally better NFP supported the dollar, though sustained yield strength continues to limit upside.

The ECB curve remains significantly flatter than the US 2s–10s, and while a theoretical ECB rate hike supports EUR, the lack of structural growth catalysts limits durability. US inflation data later this week remains the dominant risk driver.

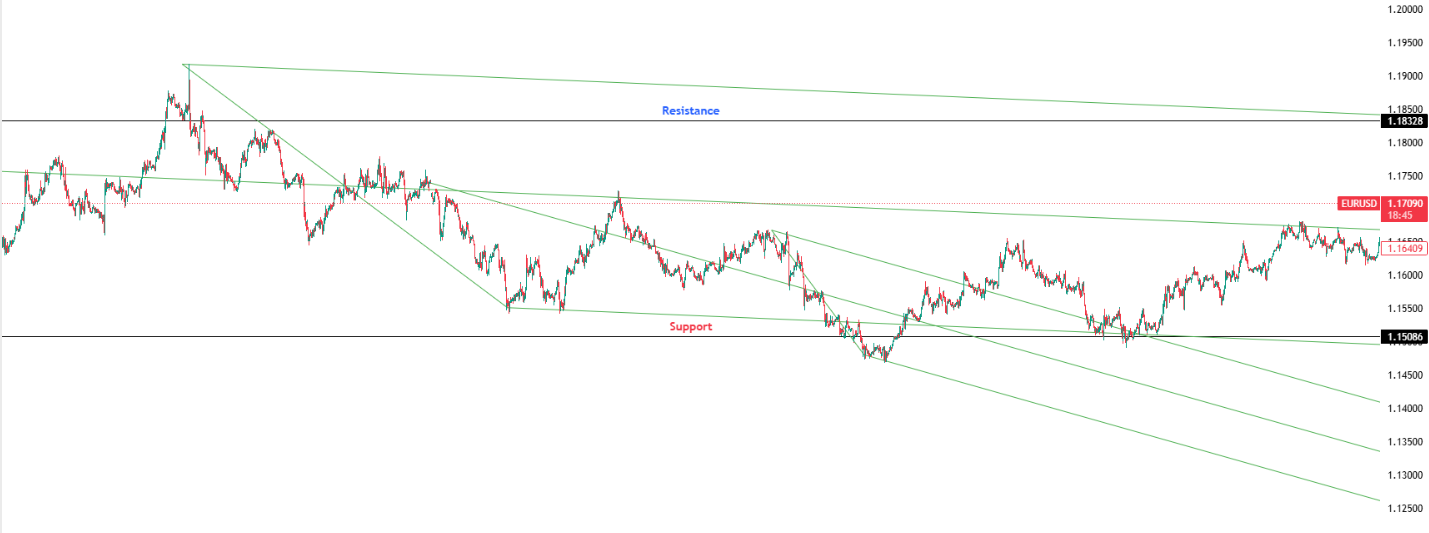

Key Levels:

Support: 1.1509 | Resistance: 1.1833

Investor Takeaway:

EUR strength remains tactical rather than structural; upside likely capped unless US inflation materially surprises.