Gold’s parabolic rally paused this month as the currency debasement narrative faded, with investors rotating back toward yield-bearing assets. ETF outflows hit multi-month highs, reversing a portion of this year’s inflows. Despite consolidation, underlying demand from central banks and retail investors remains supportive at lower levels.

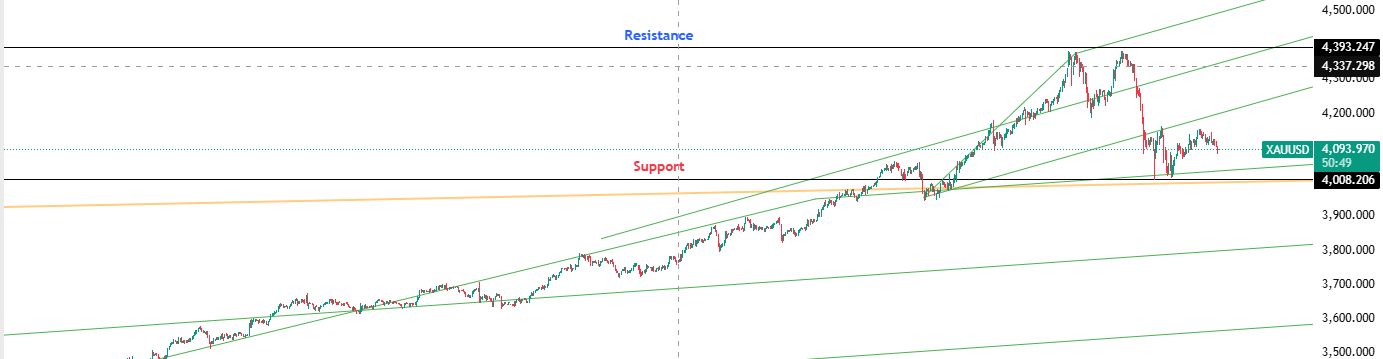

Key Levels: Support at $4,008.2 | Resistance at $4,393.2

Investor Takeaway: RSI at 42 trending downward with emerging MACD selling pressures; correction risk persists amid shifting investor focus from currency risk to real yield dynamics.