Gold maintains cautiously bearish outlook, edging upward following economic risks from poor US fiscal data. Price action suggests squeeze higher as central bank gold holdings continue increasing while ETF inflows slowed this month. Gold prices expected stable over coming weeks given lower ETF demand.

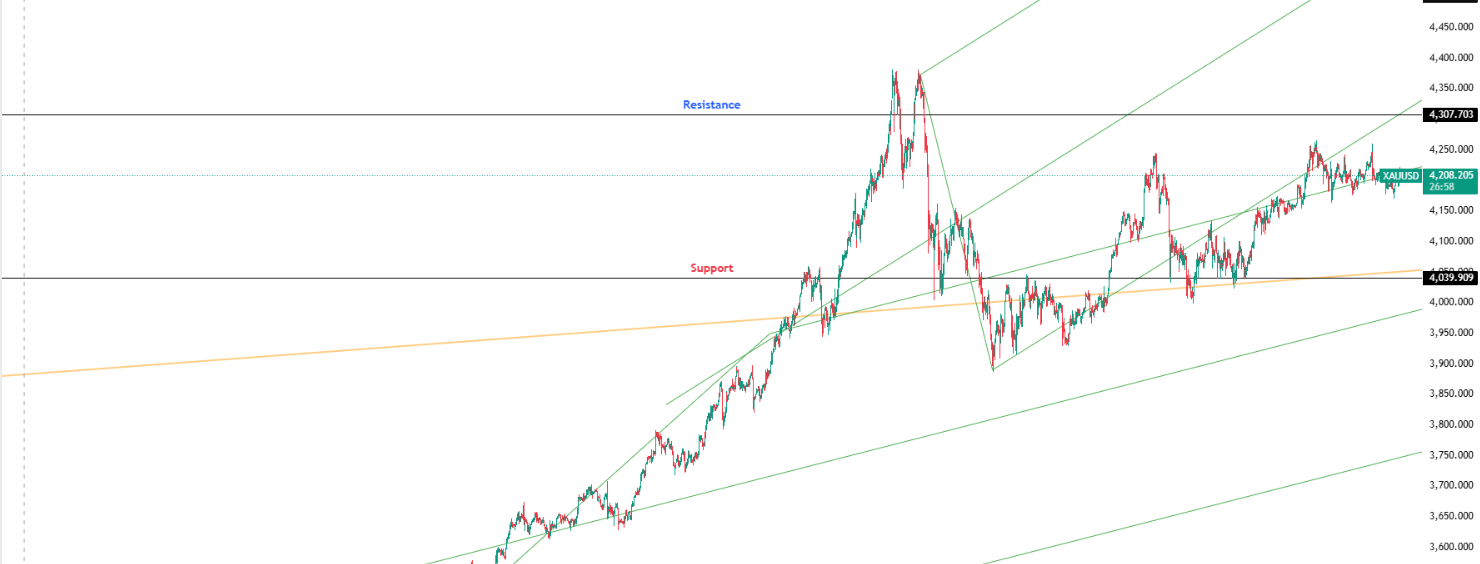

Key Levels: Support at $4,039.91 | Resistance at $4,307.70

Investor Takeaway: Central bank accumulation vs ETF weakness creating consolidation with upward bias; fiscal concerns support stability but lack of ETF interest caps near-term upside.