Gold reached new high following Trump admin’s conflict with Federal Reserve. Conflict between these institutions likely to create risk-off environment good for gold in immediate term. Price action suggests squeeze higher as central bank gold holdings continue increasing while ETF inflows slowed this month. Fed becoming buyer of bills and global pivot away from US Treasuries may push gold further up. Invasion acts as way for US to acquire more gold as Venezuela has large gold reserves.

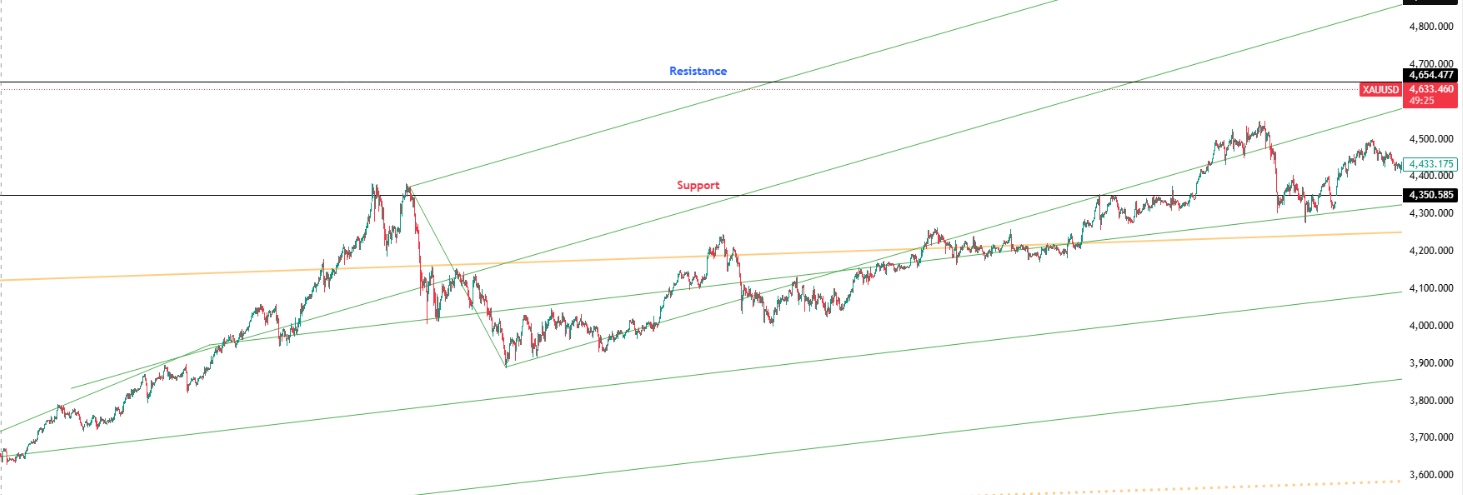

Key Levels: Support at $4,350.59 | Resistance at $4,654.48

Investor Takeaway: RSI at 63 with MACD showing reemerging bullish momentum but increased selling pressures; new high consolidation as institutional crisis offsets cooling inflation narrative.