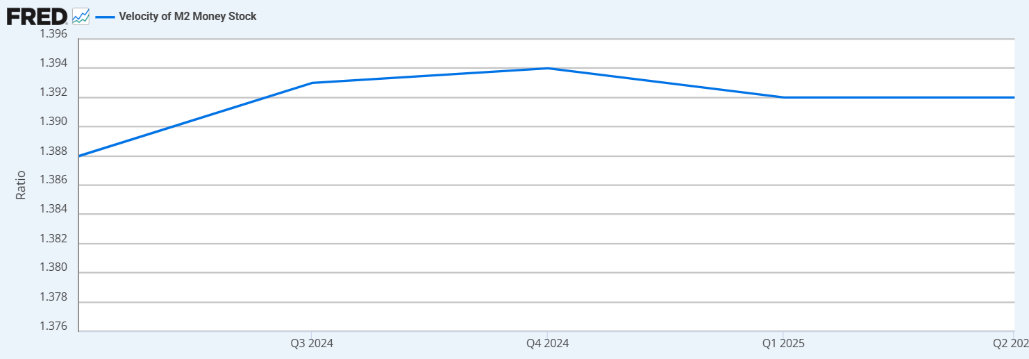

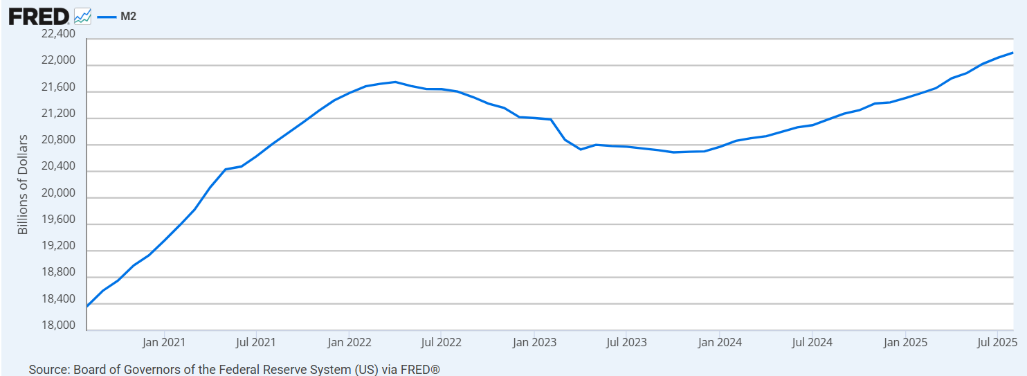

U.S. yields remain elevated as the government shutdown drags on with no signs of resolution. Treasury auctions continue to attract strong demand, reflecting ample liquidity in the system despite weak political confidence. The expansion of money supply post-COVID has been met with slowing velocity, trapping liquidity in money market funds (now ~$7T) and Treasury reserves rather than circulating in the real economy. This dynamic is creating a paradoxical backdrop: inflation remains sticky, but the absence of aggressive liquidity deployment is keeping asset prices below bubble territory.

- Shutdown Drags On: Political standoff persists, Treasury auctions remain strong.

- Liquidity Paradox: $7T trapped in MMFs, not yet circulating in real economy.

- Velocity Slowdown: Disinflation risk rising as money velocity stagnates.

- Eurozone Risks: French political crisis offset by German growth optimism.

- Abenomics Revival: Carry trade flows strengthen yen weakness.

- Gold Above $4,000: Safe-haven flows anchored by global political uncertainty.

- Tech Momentum Eases: Nasdaq rally shows early signs of fatigue.