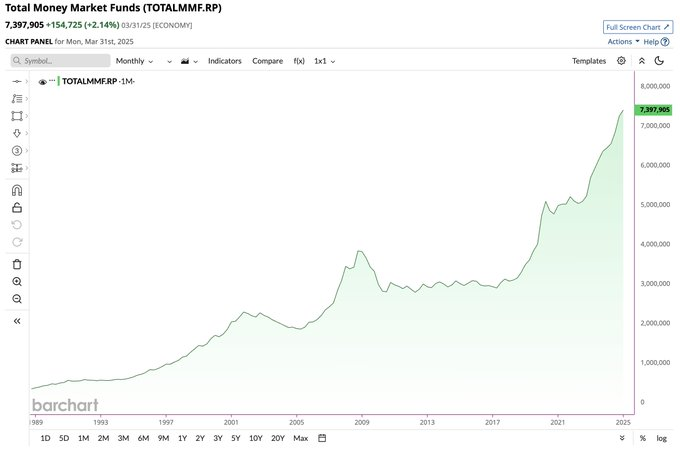

Markets begin the week balancing European political turmoil with easing U.S. yields ahead of the FOMC meeting. French Prime Minister Bayrou lost his confidence vote, leaving Europe’s second-largest economy without stable leadership as it grapples with €3.4 trillion in debt. Meanwhile, U.S. yields are slipping as investors price in a 90% chance of Fed rate cuts, which could redirect the $7.4 trillion sitting in money market funds into riskier assets. The result: equities show resilience, the euro wobbles, and safe havens remain in play.

- French politics: Government collapse reignites eurozone instability fears.

- U.S. yields: Money market peak suggests fresh flows into equities as cuts near.

- Data risk: PPI and CPI later this week could reset Fed expectations.

- Safe havens: Gold stays elevated, silver more volatile but bullish.