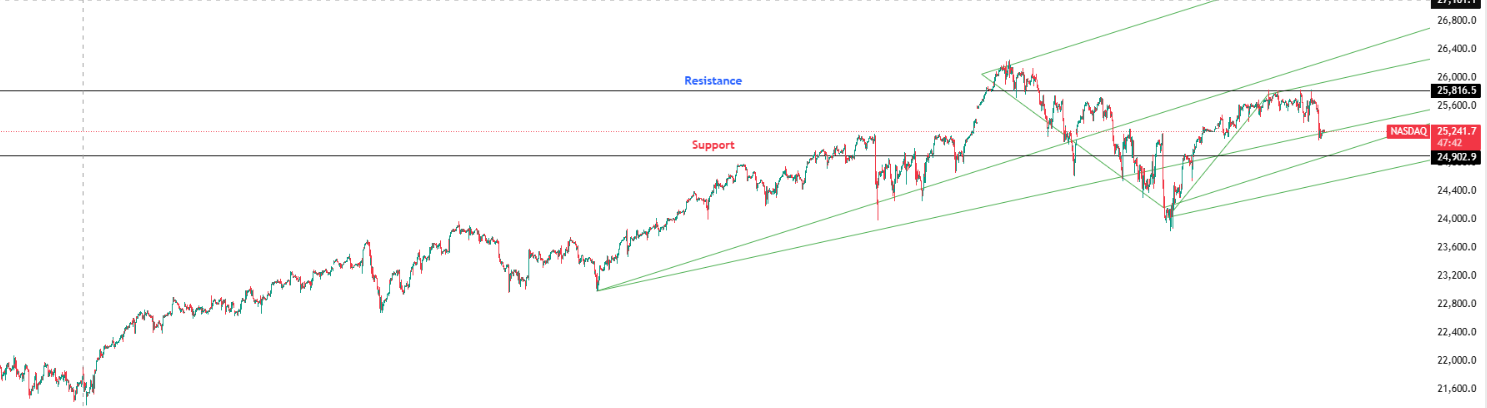

Outlook: Cautiously Bullish

Timeframe: 1 Day

Technical Outlook

- RSI and MACD remain bearish despite strong earnings prints (notably AVGO).

- Market attention is shifting to balance sheet and credit concerns, particularly around large enterprise software names.

- Further downside risk persists unless upcoming data improves macro visibility.

Key Levels

Support: 24,902.9 │ Resistance: 25,816.5

Investor Takeaway

Earnings alone are insufficient to lift tech; rate clarity and credit confidence are now required.