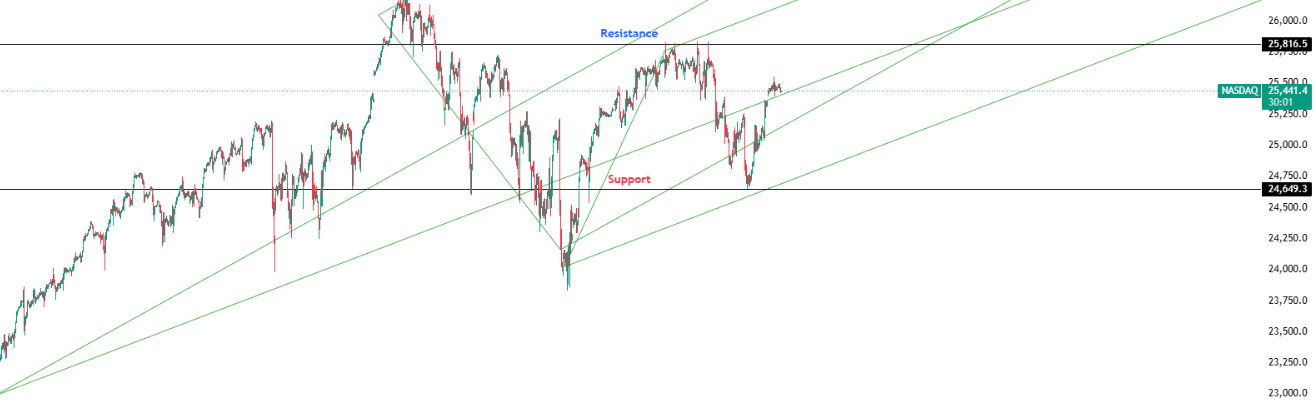

Outlook: Cautiously Bullish

Time Horizon: 1 Day

- RSI has converged with its moving average and is rolling modestly lower.

- MACD shows emerging selling pressure following the recent relief rally.

- Lower CPI pushed rate-cut expectations higher, driving a sharp upside move before consolidation.

- Medium-term fundamentals remain supportive, with earnings growth and an expected economic reacceleration into 2026.

Key Levels:

Support: 24,649.3 | Resistance: 25,816.5

Investor Takeaway:

Nasdaq is consolidating gains after a CPI-driven rally. Trend remains intact, but near-term upside may pause without renewed rate catalysts.