The Nasdaq 100 remains cautiously bullish, supported by improving earnings visibility and expectations of economic reacceleration in 2026. While near-term technicals remain soft, corporate profitability—driven by consumption growth and government spending—continues to strengthen the medium-term outlook.

The next leg of earnings growth is increasingly expected to come from memory and semiconductor firms, with recent upside surprises from Micron and Seagate reinforcing the AI-driven demand thesis.

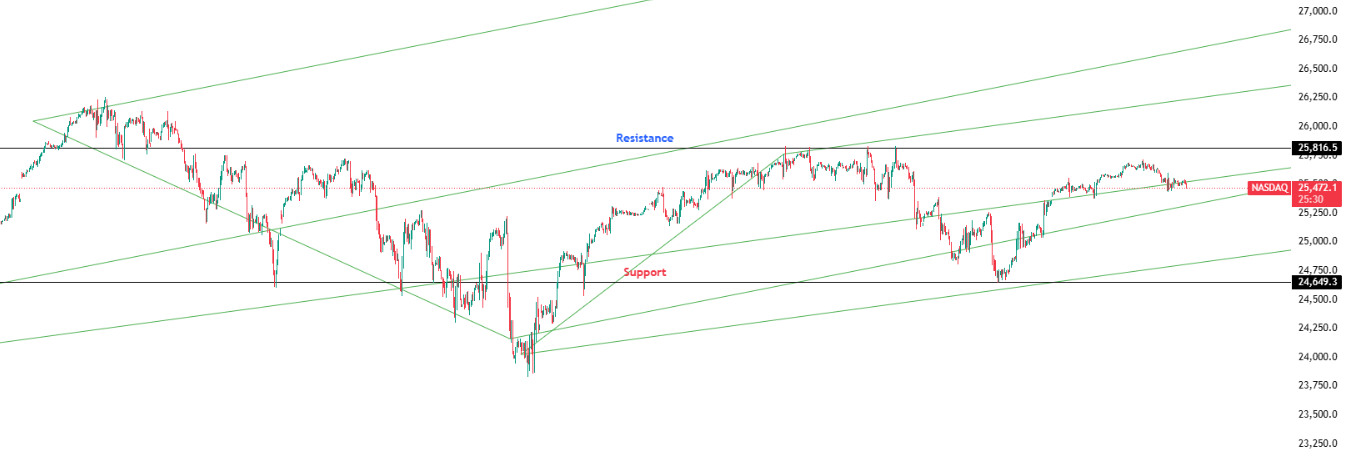

Key Levels: Support 24,649.30 | Resistance 25,816.50

Investor Takeaway: RSI continues to trend lower below its MA, but emerging MACD buying pressure suggests downside momentum may be fading ahead of a potential 2026 re-rating.