Corporate profitability driven by consumption growth and government spending will likely push for further growth in 2026. Earnings growth combined with expected reaccelerating economy likely to push Nasdaq growth further. Nasdaq might see next leg of earnings growth come from memory and semiconductor firms seeing exponential demand, as seen by growth in Micron (MU) and Seagate (STX) earnings beats.

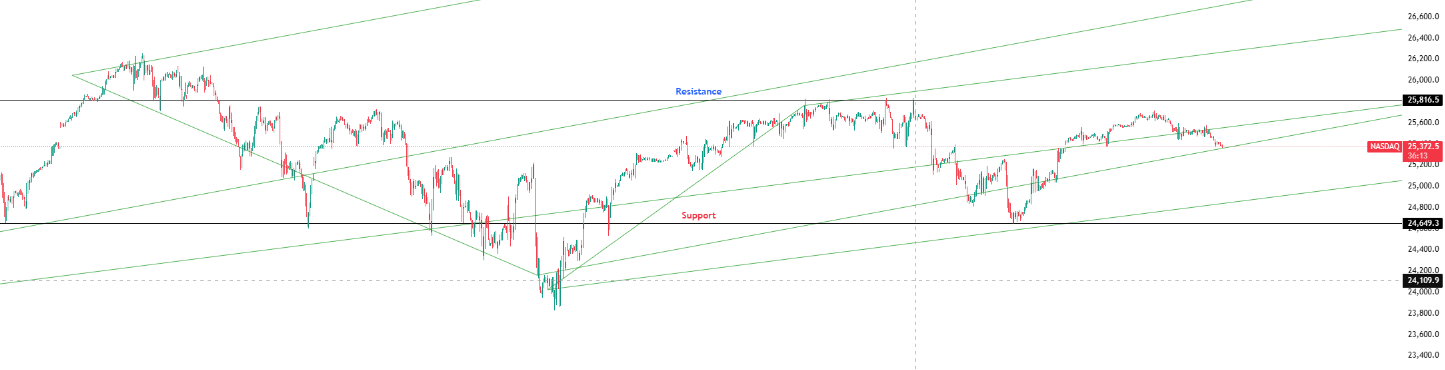

Key Levels: Support at 24,649.30 | Resistance at 25,816.50

Investor Takeaway: RSI below 30 under MA line consistently trending downward; MACD shows emerging selling pressures but memory/semiconductor exponential demand thesis provides 2026 catalyst