The Nasdaq remains cautiously bullish as CES 2026 reinforced long-term AI and data-center investment themes. AMD unveiled its Ryzen AI 400 series, positioning itself as a key player in on-device generative AI, while Nvidia confirmed production of its next-generation Vera Rubin architecture aimed at improving performance-per-watt for hyperscale AI clusters. Earnings growth, government spending, and consumption resilience continue to underpin the medium-term bullish case for tech into 2026.

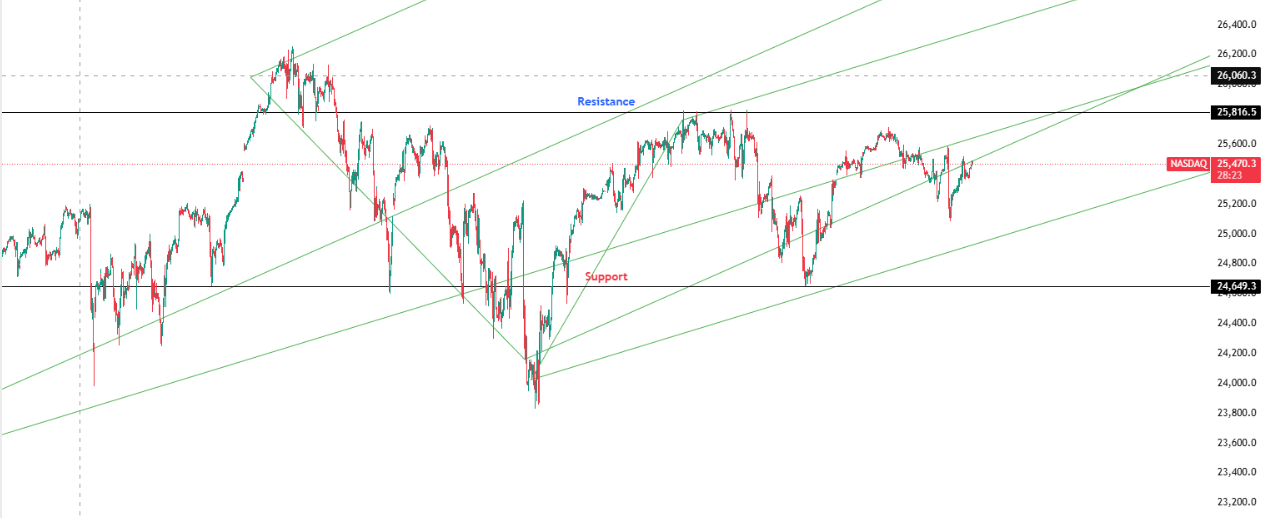

Key Levels: Support at 24,649.3 | Resistance at 25,816.5

Investor Takeaway: RSI at 64 trending higher with emerging MACD buying pressure; structural AI investment and earnings growth support continued upside despite near-term consolidation risks.