The S&P 500 maintains cautiously bullish stance as elevated yields persist from lack of confidence in economic data. BLS cancelled October PPI report release—Fed operating on fewer data points for tomorrow’s rate decision. US fighting battle on four fronts: (1) Trade: Tariffs on major trading partners creating input cost inflation for wholesalers passing to retail; (2) Regulation: Overregulation in housing, energy production, banking/finance, and manufacturing making it impossible to keep inflation low by increasing supply; (3) Fiscal spending: Debt ceiling climbing to $41 trillion following OBBA passage; Treasury consistently raising short-term debt to finance operations plus stimulus packages—spending leading to fiscal dominance adding inflationary pressures; (4) Liquidity: 3 years of QT led to sharp Fed balance sheet decline—down 51% now at 2020 levels. RRP drawdown and TGA size increase resulted in limited real economy liquidity. Fed buying USTs likely to push bond markets into bull run; OBBA provisions kicking in should mean more cash available for real economy participants. Tariffs may act as wealth/consumption tax for wealthy, spurring government revenues. US has tools to fight issues but must act with precision, not hastily.

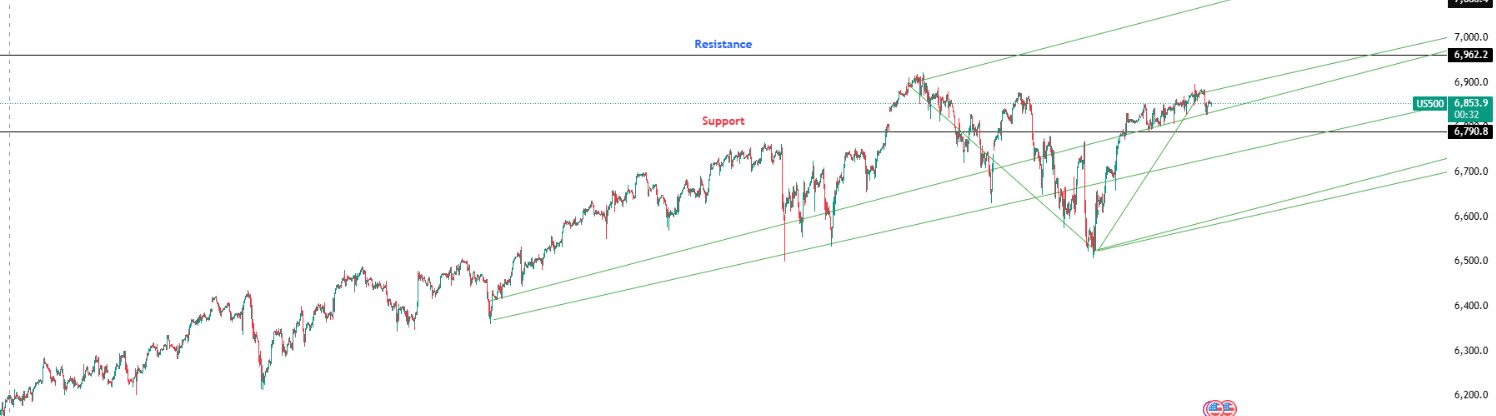

Key Levels: Support at 6,790.80 | Resistance at 6,962.2

Investor Takeaway: Approaching pitchfork intersection with neutral MACD; four-front battle complex but Fed UST buying and OBBA provisions provide potential catalysts for bull run.