The S&P 500 maintains cautiously bullish stance as US yield curve enters bull steepened phase. Green curve (Dec 9, 2025) far steeper than other curves—steepness exaggerated compared to blue curve (June 1, 2025) with lower maturity yields far below June levels. Result of US government raising significant debt in lower maturities plus expectations of looser monetary environment. Equity markets remained flat past month on looser monetary expectations. Today’s Fed rate decision likely to significantly affect market moves. Lowered rates, Fed balance sheet expansion, and stronger economic growth prospects are possible market growth drivers in coming months. US still suffering from subdued consumption and economic activity with weak labor market driving poor sentiment. Looser monetary environment coupled with liquidity deployments should help prop market up soon. Yesterday’s October JOLTS report showed labor market weakness persists, though better than summer metrics.

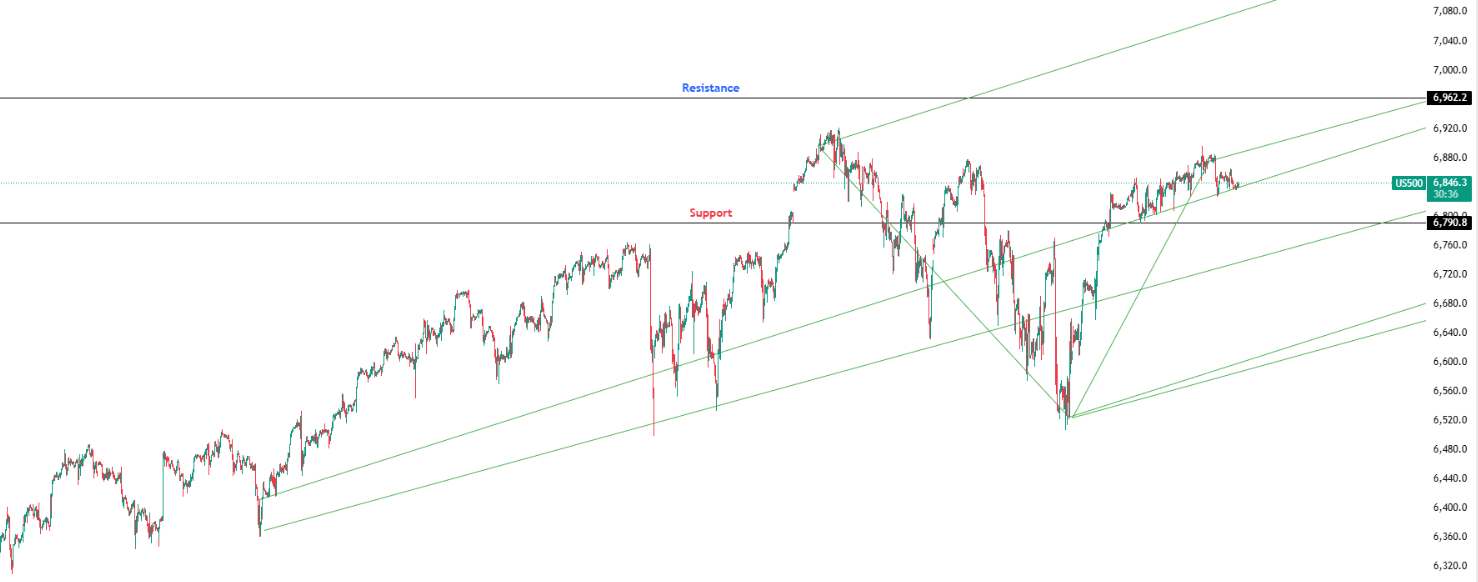

Key Levels: Support at 6,790.80 | Resistance at 6,962.2

Investor Takeaway: Approaching pitchfork intersection with neutral MACD; bull steepener and today’s Fed decision are critical catalysts for breakout above resistance.