Yields fell yesterday following FOMC meeting delivering 25 bps cut—third straight cut this year as market predicted. Cut deemed “hawkish” with Powell stating Fed has done enough for now, reiterating current 3.5-3.75% band is the neutral rate. Powell admitted he believes US BLS is overstating job numbers, explaining rationale for cut. Fed currently divided on further cuts with Miran advocating more cuts clashing with Goolsbee opposing. Most interesting development: Fed plans to buy US T-bills going forward instead of buying all bonds. Move makes RRP more lucrative to money market funds holding nearly $7 trillion in dry powder. T-bill buying critical for banking reserves: every Fed T-bill purchase is paid by editing commercial bank’s reserve account, mechanically increasing reserves. With RRP nearly empty, no buffer remains—in 2023-24, MMFs funded Treasury by pulling from RRP leaving reserves unaffected; that mechanism is now gone. Going forward, bill purchases flow directly into banks as sellers settle through commercial banks, meaning every Fed bill purchase shows up as higher bank reserves. Essentially, more reserves in banking system means more credit growth and lower-priced credit, spurring economic activity.

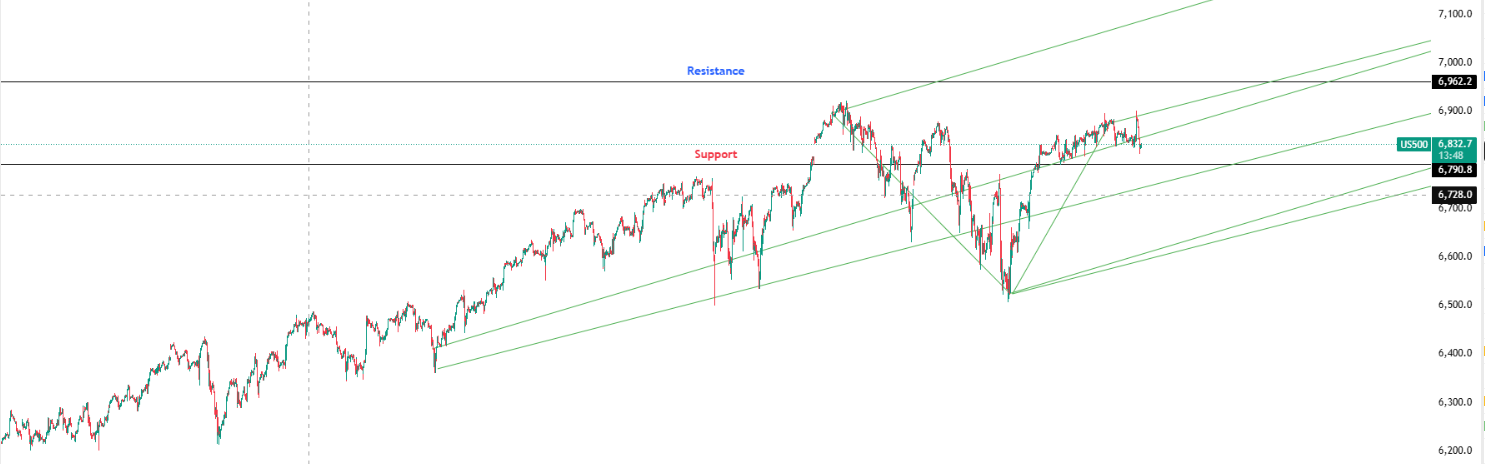

Key Levels: Support at 6,790.80 | Resistance at 6,962.2

Investor Takeaway: Approaching pitchfork intersection with neutral MACD; hawkish cut tone overshadowed by T-bill buying program mechanically boosting bank reserves for credit expansion.