The S&P 500 maintains a cautiously bullish stance as US yields eased slightly ahead of a dense economic data week. The Treasury curve continues to steepen in the 2Y–10Y segment, driven by a declining 10Y yield. Treasury Secretary Bessent has reiterated that lowering the 10Y below 4% is a central policy objective of the Trump administration, viewing it as critical to reducing economy-wide borrowing costs.

The administration expects deregulation, energy independence, and tariff-driven revenue to suppress inflation and naturally pull long-end yields lower. A lower 10Y combined with curve steepening would materially improve liquidity and credit conditions heading into 2026.

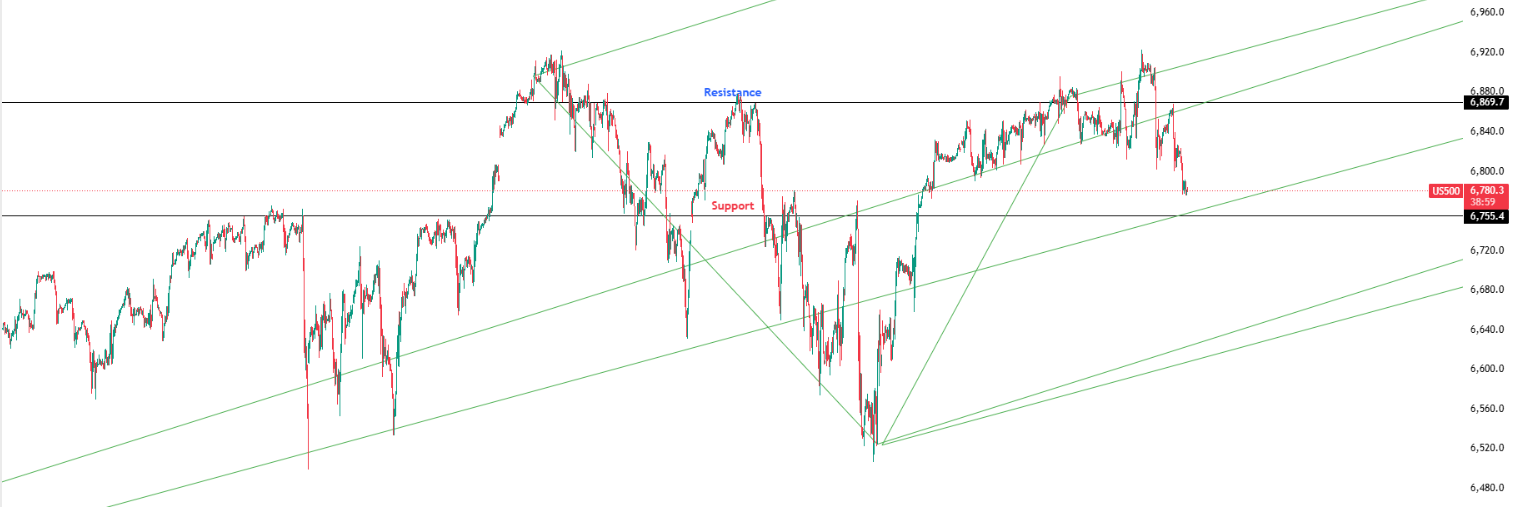

Key Levels: Support at 6,755.4 | Resistance at 6,869.7

Investor Takeaway: MACD remains bearish but momentum loss suggests a potential reversal as price approaches a pitchfork intersection; improving curve dynamics provide a supportive macro backdrop.