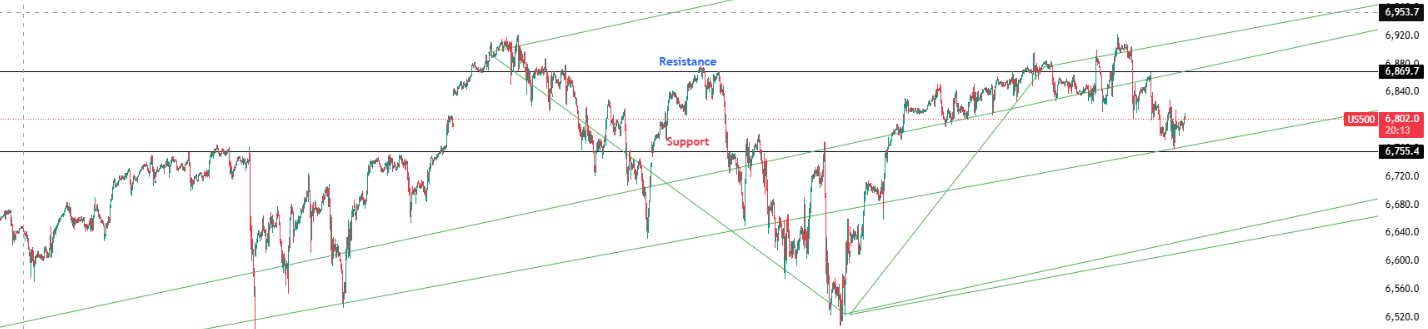

Outlook: Cautiously Bullish | Timeframe: 1 Day

US equities remain cautiously supported despite deteriorating labor data. The delayed November jobs report showed a modest 64K gain, offset by a 105K loss in October, while the unemployment rate rose to 4.6%, marking a 0.6pp increase YTD. Job creation remains narrowly concentrated in healthcare and construction, while federal employment continues to decline amid policy cutbacks and lingering shutdown effects.

Core retail sales surprised to the upside (+0.4%), suggesting consumer resilience, though headline retail sales remained flat. Manufacturing PMI was unchanged, while services softened seasonally. Equity markets remain uneasy as a K-shaped economic recovery complicates earnings visibility. However, coordinated policy actions from the Federal Reserve, US Treasury, and the Trump administration’s deregulation agenda are expected to provide cyclical relief heading into 2026.

Key Levels:

Support: 6,755.4 | Resistance: 6,869.7

Investor Takeaway:

Bearish momentum is fading near a key pitchfork intersection. While macro data remains fragile, policy tailwinds could support an upside resolution if resistance breaks.