Yields rose yesterday despite massive unexpected drop in inflation. November 2025 CPI released December 18: Headline CPI rose 2.7% YoY, missing forecasts of 3.1% and down from September’s 3.0%. Core CPI excluding food and energy came in at 2.6%, also below expectations of 3.0%. Drop driven by declining apparel and tourism prices. Largest increase came from energy prices as expected—electricity bottlenecks remain consistent issue for US public. Energy prices may begin dropping next year as US natural gas supplies continue in glut. Following inflation print, S&P 500 ripped into 6.8K-6.9K territory then retraced. Soft inflation print increased probability of rate cut further—25 bps cut probability rising to 25% for next FOMC meeting.

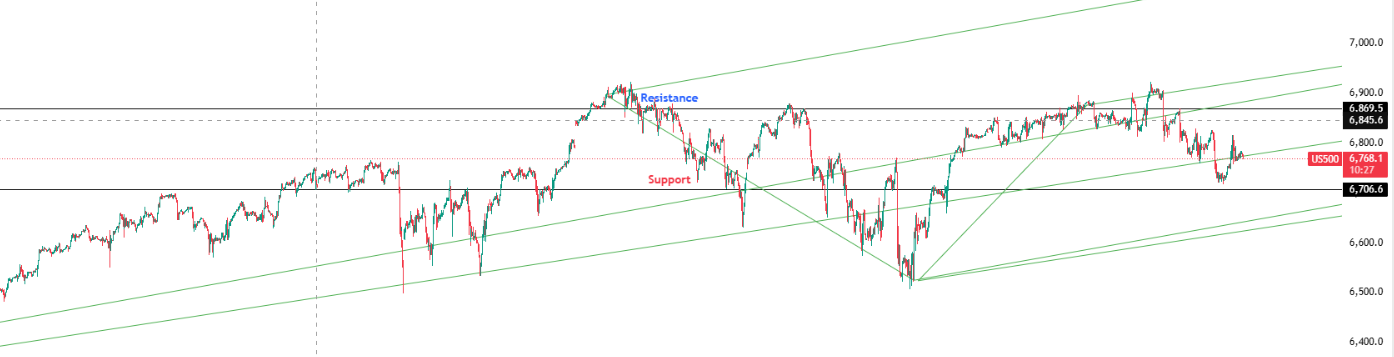

Key Levels: Support at 6,706.60 | Resistance at 6,869.50

Investor Takeaway: Rebound keeps prices between bottom and middle prong of hourly pitchfork; RSI at 54 below MA line with neutral MACD, rate cut odds rising on dovish CPI surprise.