Headline CPI for November 2025 printed at 2.7% YoY, materially below the 3.1% consensus, triggering an initial rally into the 6.8K–6.9K zone before prices retraced. The downside surprise was driven primarily by declines in apparel and tourism-related categories. Energy prices posted the largest increase, reflecting ongoing electricity bottlenecks, though expectations of a US natural gas glut in 2026 may ease cost pressures over time.

The inflation miss lifted the implied probability of a 25bp rate cut at the next FOMC meeting to ~25%, though yields failed to meaningfully roll over, suggesting markets remain cautious about extrapolating a single data point.

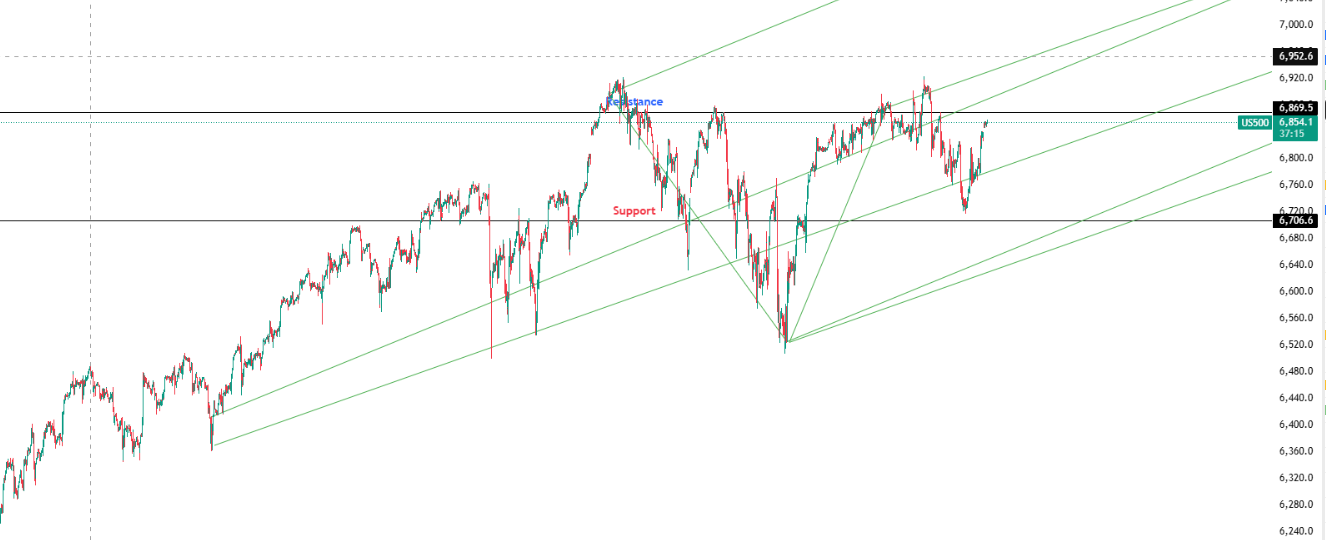

Key Levels: Support 6,706.60 | Resistance 6,869.50

Investor Takeaway: Price action remains confined between the lower and median prongs of the hourly pitchfork.

RSI at 54 sits below its MA, while MACD momentum is neutral—indicating consolidation following CPI-driven volatility rather than trend continuation.