Outlook: Cautiously Bullish

Time Horizon: 1 Day

- US yields declined as markets entered holiday-thinned trading conditions.

- The move appears driven by cooling inflation expectations alongside incremental liquidity support from the US Treasury and Federal Reserve.

- Notably, yields had risen for two consecutive sessions following the inflation release, suggesting residual inflation sensitivity before the recent pullback.

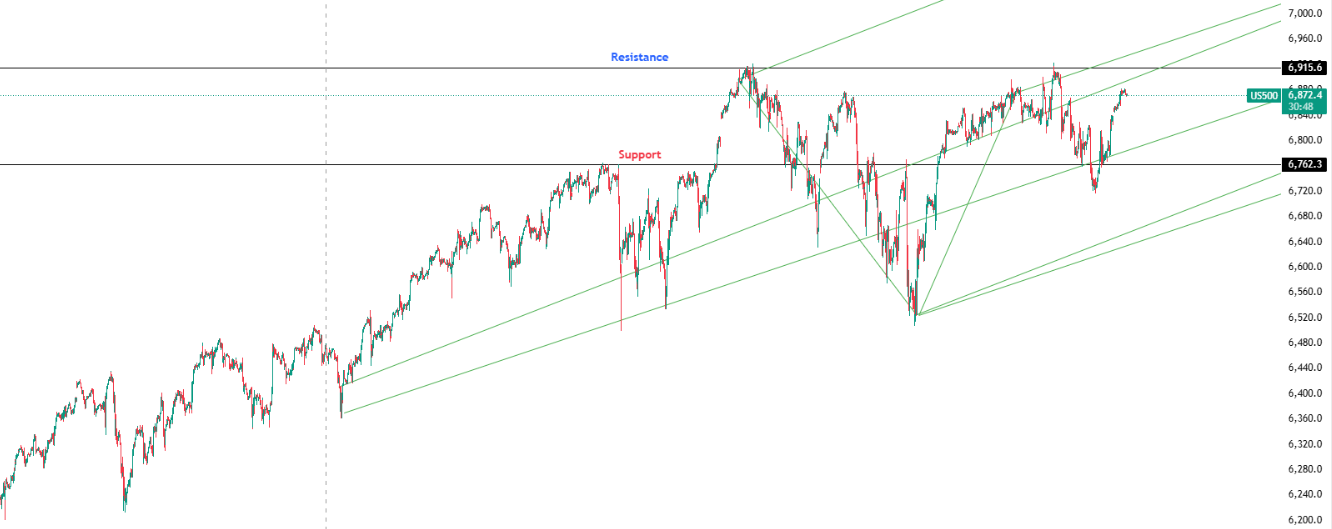

Technical Outlook

- Price remains anchored between the lower and median prongs of the hourly pitchfork.

- Index has cleared R1, reinforcing short-term bullish structure.

- RSI sits at 58, below its moving average, indicating momentum remains constructive but not overextended.

- MACD reflects mild selling pressure, consistent with post-rally digestion.

Key Levels:

Support: 6,762.3 | Resistance: 6,915.6

Investor Takeaway:

Holiday liquidity and falling yields are supportive, but momentum remains controlled. A sustained break above resistance would be required to confirm continuation.