The S&P 500 maintains a cautiously bullish short-term outlook as optimism for 2026 continues to build. Short-dated yields have fallen sharply while the curve remains steep, reinforcing expectations of an easier financial environment next year. Consensus forecasts increasingly point to a fourth consecutive year of positive US equity returns in 2026.

The seasonal Santa Rally failed to gain traction in 2025, reflecting weak confidence and the economic constraints imposed throughout the year. However, many of these pressures—tight liquidity, elevated rates, and fiscal drag—are expected to normalize into 2026. Treasury Secretary Bessent has highlighted affordability as a key policy focus, noting that while rate policy can support incomes, input cost inflation must be addressed through deregulation rather than monetary tools.

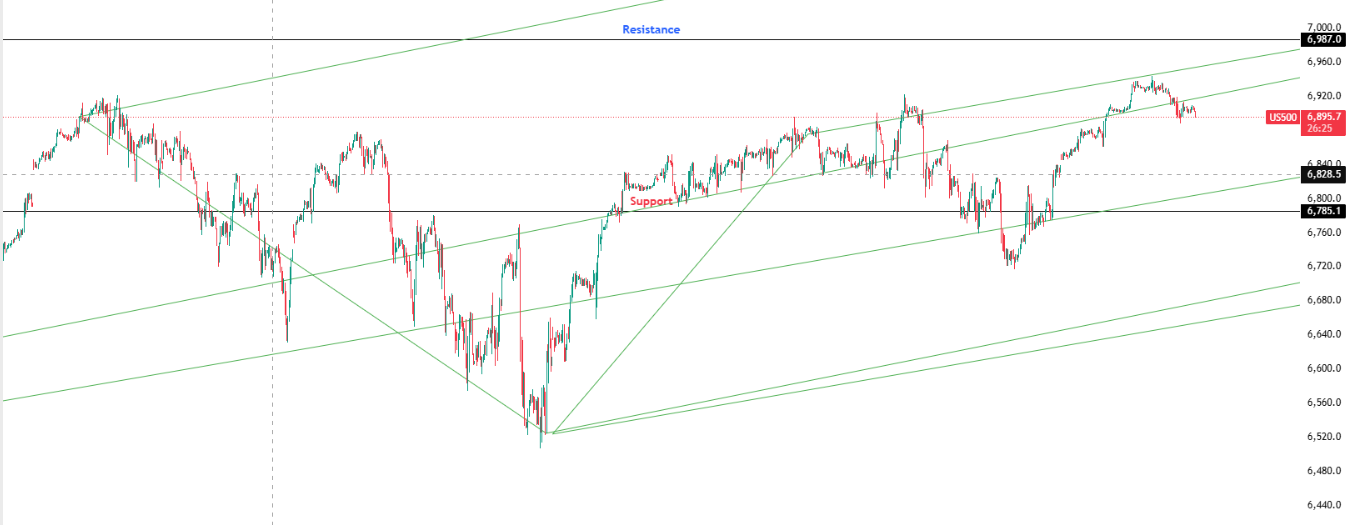

Key Levels: Support 6,785.10 | Resistance 6,987.00

Investor Takeaway: RSI at 41 remains below its MA with flat MACD selling pressure. Price action suggests consolidation ahead, but falling front-end yields continue to underpin medium-term equity optimism.