US equities ended the year on a softer note as rising yields and fading Santa-rally momentum weighed on sentiment. While the yield curve remains steep, a sustained move in the 10Y Treasury below 4.10% would act as a meaningful tailwind by easing financial conditions and lowering the cost of credit. The broader macro drag from 2025 is expected to normalize into 2026, particularly if fiscal affordability becomes a policy priority.

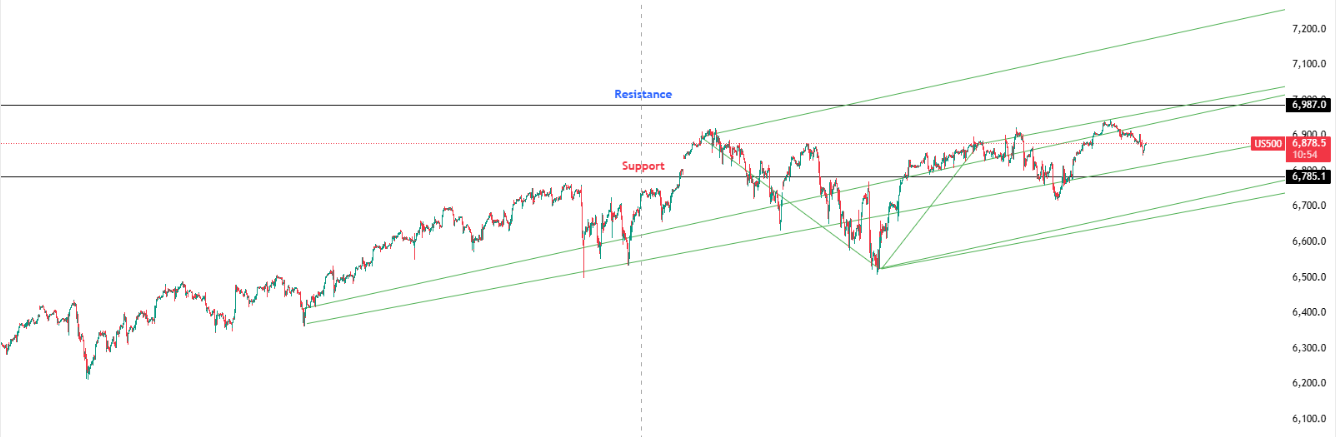

Key Levels: Support at 6,785.10 | Resistance at 6,987.00

Investor Takeaway: RSI sits slightly above its MA at 51 while MACD remains flat, signaling consolidation rather than trend exhaustion. Price action suggests cautious bullish positioning, contingent on a sustained decline in long-end yields.