US Invades Venezuela, Captures Maduro—Resource Acquisition Drives Futures Rally

Yields fell Friday with markets moving toward risk-on sentiment. Big story from past week: US invasion of Venezuela and capturing of Nicolas Maduro marks yet another regime change orchestrated by US. Stock futures rose after invasion as rumors of resource acquisition now in play. Venezuela’s resource base—especially oil, gas, and critical minerals—creates major potential gains for US state and corporate interests if Washington follows through on Trump’s stated intent to “run” country and seize its oil. Venezuela holds world’s largest proven oil reserves and very large gas deposits, giving any outside power controlling them significant leverage over global energy markets and specific bilateral relationships (e.g., with China, India). Trump and senior officials explicitly talked about seizing Venezuelan oil and selling it to other countries, tying operation to US energy security and corporate access. Venezuela’s massive external debt and defaulted bonds create space for US-backed restructurings that swap relief for collateralized claims on specific projects or revenue streams (oilfields, ports, refineries, mines). Frozen Venezuelan state assets abroad can be repurposed to fund new regime that signs resource access deals favorable to US interests. Invasion essentially allows US to acquire strategic assets and maintain hold over LatAm. Defense and O&G sectors are easy beneficiaries of invasion.

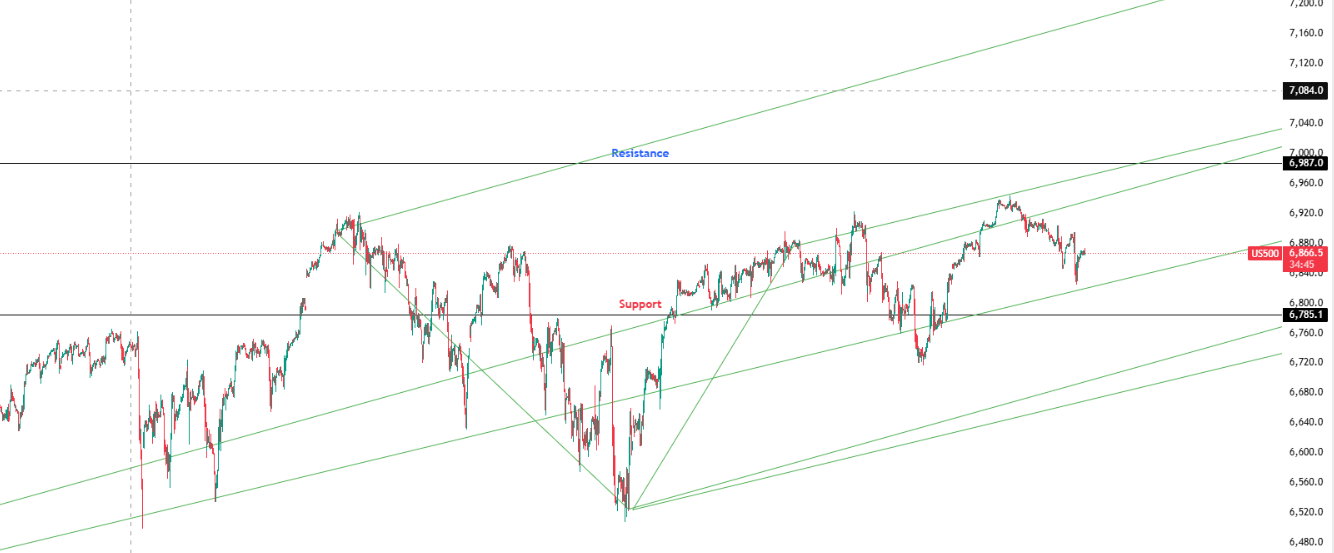

Key Levels: Support at 6,785.10 | Resistance at 6,987.0

Investor Takeaway: RSI at 53 above MA line with flat MACD buying momentum; Venezuela invasion creates resource acquisition tailwind for defense and O&G sectors with geopolitical risk premium.