Yields fell yesterday following JOLTS and ADP’s unemployment data. JOLTS showed labor demand cooling further but not collapsing, while ADP showed small rebound in private hiring still weaker than pre-2025 norms, giving “Goldilocks” mix of softer demand and still-positive job growth. Openings essentially flat at 7.1 million in November, down from revised 7.4 million in October—lowest level in about five years. Continues downtrend from 2022-23 peak, pointing to cooler but not collapsing labor market with fewer vacancies relative to workers. ADP showed private payrolls up 41,000 in December, rebounding from November’s 29,000 job loss but slightly below roughly 48,000 consensus. December’s gain effectively offset November’s decline, leaving late-2025 hiring tepid but stabilizing rather than continuing to deteriorate. Sectoral breakdown: All net job growth came from services—education/health added ~39,000, leisure/hospitality 24,000, trade/transport/utilities 11,000, financial services 6,000. Professional/business services lost 29,000, information shed 12,000, goods-producing industries overall lost 3,000, led by 5,000 manufacturing drop. Investors now looking forward to Friday’s NFP.

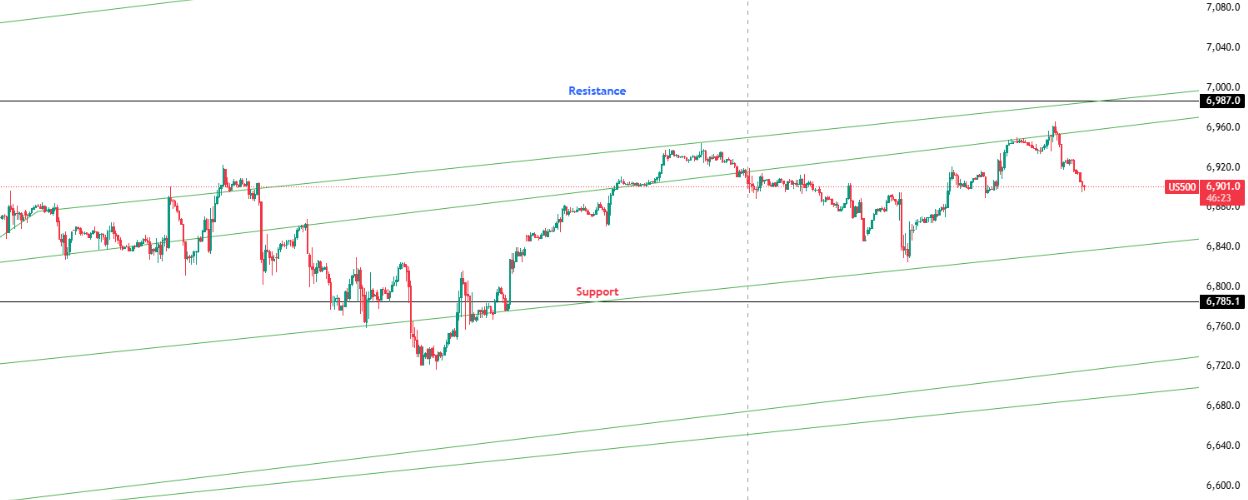

Key Levels: Support at 6,785.10 | Resistance at 6,987.0

Investor Takeaway: RSI at extreme oversold 28 below MA line with emerging MACD selling momentum; “Goldilocks” data (cooling but not collapsing) supports soft landing narrative but services/goods divide deepens.