Yields fell yesterday after CPI data showed no signs of heating up. Headline CPI: Up 0.3% m/m and 2.7% y/y, exactly in line with consensus and unchanged from November, keeping inflation below 3% for second straight month. Core CPI (ex food & energy): Up 0.2% m/m (vs 0.3% expected) and 2.6% y/y—four-year low and 0.1ppt cooler than forecasts, signaling continued disinflation in underlying prices. Goods vs services: Core goods inflation slowed to ~1.4% y/y with tariff-related pressure largely fading as retailers absorbed some costs. Core services ran near 3.0% y/y, with “supercore” (core services ex-housing) at 2.7% y/y, down from roughly 4% year earlier, showing ongoing but gradual cooling in sticky part of CPI. Food and energy: Food prices rose ~3.1% y/y while energy index up 2.3% y/y, modestly contributing to headline but not driving new spike. Given inflation still above Fed’s 2% target, likelihood of rate cut in January FOMC meeting running low. Today’s PPI data will shed further light on where inflation headed over coming months.

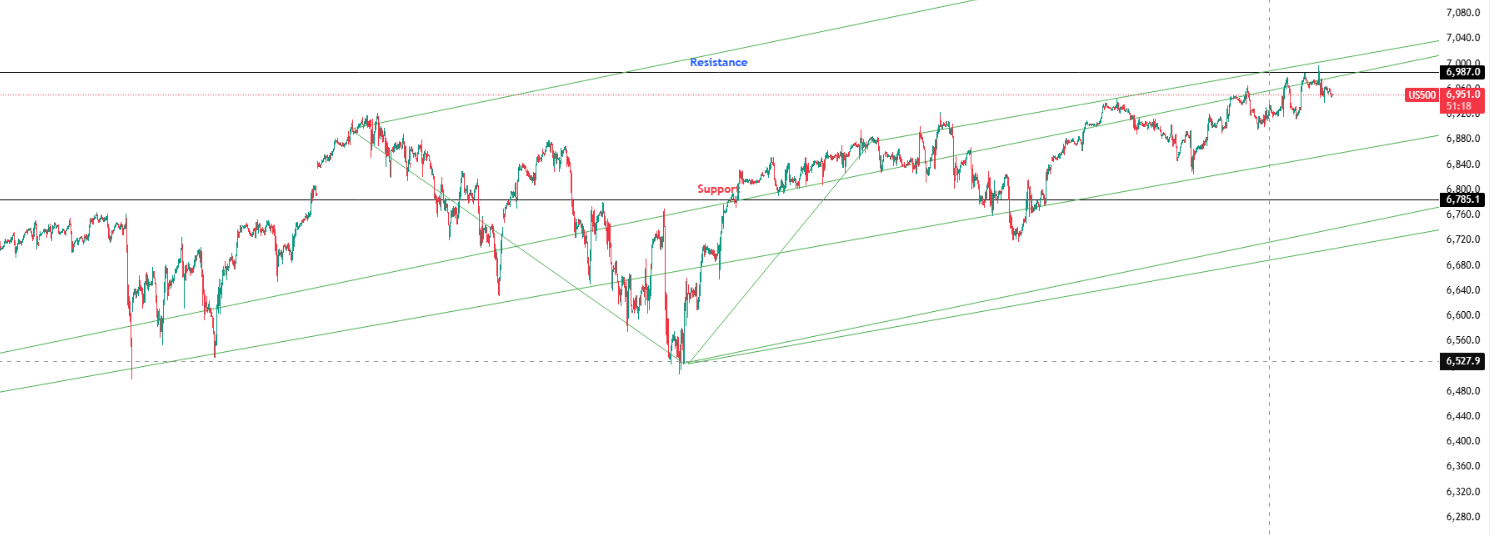

Key Levels: Support at 6,785.10 | Resistance at 6,987.0

Investor Takeaway: RSI at 41 below MA line with flat MACD selling momentum; core CPI at 4-year low signals disinflation progress but 2.7% headline keeps January cut unlikely—PPI data today critical for confirming trajectory.