The Bank of Japan raised rates by 25bp to ~0.75%, marking its highest policy rate in roughly three decades and reinforcing a decisive break from negative rates and yield curve control. The move aligns with private-sector expectations and reflects mounting political pressure to curb import- and energy-driven inflation stemming from prolonged yen weakness.

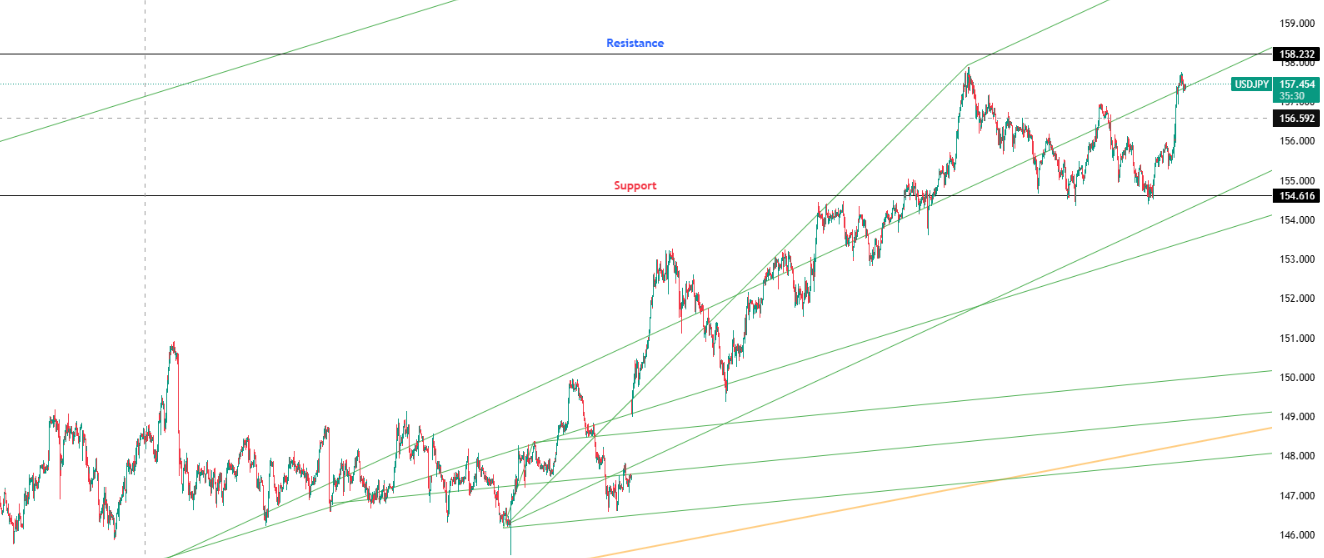

Key Levels: Support 154.616 | Resistance 158.232

Investor Takeaway: Policy divergence is narrowing, shifting focus toward structural drivers. RSI remains above its MA but is trending lower, suggesting downside risk as the market digests Japan’s normalization path.